June 8, 2025

Let’s be honest: seeing strong brands stumble in Malaysia’s vital Malay-speaking markets is surprisingly common. They’ve got quality products, maybe even great marketing, yet reaching their true sales potential feels like an uphill battle. What’s the missing link? Often, it boils down to one critical, yet underestimated factor: getting pharmacy distribution service in Malaysia fundamentally right. And here’s the thing – in these culturally distinct regions, distribution isn’t just trucks and warehouses. It’s a complex dance involving deep-rooted trust, strict compliance, genuine cultural sensitivity, and razor-sharp strategic alignment.

Imagine pouring resources into your brand, only to face empty shelves at key outlets, or worse, whispers of distrust among local pharmacists. A single misstep within your pharmacy distribution Malaysia strategy – maybe a culturally insensitive approach or a regulatory oversight – can trigger exactly that. The fallout is real: products gathering dust instead of gaining visibility, unexpected regulatory backlash that halts momentum, and lasting damage to how your brand perception resonates with both retailers and end consumers. For players in this space – whether you’re an independent pharmacy distributor, managing a distributor pharmacy, or operating as a large pharmacy wholesale distributor – these aren’t abstract risks. They’re costly pitfalls threatening market share and growth every single day.

So, why keep reinventing the wheel and risking these expensive errors? Understanding the specific mistakes that derail success in Malay-speaking markets is the crucial first step towards building a robust, resilient channel. This article dives deep into the most frequent and damaging missteps we see brands making across the Malay-majority regions. More importantly, we move beyond just identifying problems. We’ll unpack practical, actionable strategies designed specifically to help you navigate these complexities. The ultimate goal? Ensuring your products consistently reach the right customers, presented in the right way, precisely at the right time. Because in Malaysia’s competitive pharmacy landscape, flawless distribution execution isn’t just nice-to-have; it’s the absolute foundation for sustainable growth and brand loyalty.

Let’s be blunt: regulatory mistakes rank among the most expensive errors any distributor can make in Malaysia. Are you absolutely certain your products, especially supplements, skincare, or medicines, meet every single requirement? Overlooking the standards set by agencies like the NPRA (National Pharmaceutical Regulatory Agency) or the KKM (Ministry of Health) isn’t just a paperwork issue. The real-world consequences are severe – think shipments seized at customs, hefty financial penalties, or even getting your business blacklisted entirely. For any pharmacy distributor Malaysia relies on, ensuring documentation isn’t just complete, but meticulously precise, fully up-to-date, and officially approved is non-negotiable.

So, where do companies typically stumble? Several common pitfalls trip up even experienced teams:

Misclassifying Products: Accidentally registering something under “food” when it should clearly be a “supplement” (or vice versa) is a surprisingly frequent error with big repercussions.

Incomplete or Non-Compliant Dossiers: Submitting product information dossiers that miss crucial data or simply don’t align with NPRA/KKM formatting and content rules leads to instant rejection or delays.

Assuming Overseas Approval Suffices: A dangerous misconception! Just because a product is registered successfully in Singapore, Europe, or the US absolutely does not guarantee automatic approval under Malaysian regulations. Local requirements are distinct.

Consider this real-life warning: A well-known international supplement brand was eager to launch in Malaysia. However, they overlooked the NPRA’s mandatory Notification (NOT) process for certain categories. The result? Their entire initial shipment got stuck at port for a brutal 45 days. This costly hold-up delayed their market entry by over two months and racked up thousands in avoidable storage fees alone.

Avoiding these expensive headaches requires proactive steps:

Engage Local Regulatory Expertise: Partnering with a consultant who possess deep, hands-on experience navigating both the NPRA and MDA (Medical Device Authority) is invaluable. They know the nuances.

Confirm Registration Pathways Early: Never assume. Validate before manufacturing whether your product needs a simple Notification (NOT) or the full Medical Product Advertisement and Sales Permit (MAL) process.

Keep Documentation Current: Rigorously maintain your Certificates of Analysis (CoA) and Good Manufacturing Practice (GMP) certifications; letting these lapse is an invitation for trouble.

When uncertainty arises – and it often does in complex regulatory landscapes – don’t gamble. Always seek guidance from a dedicated pharmacy distribution service in Malaysia. Choose one that manages these intricate regulatory workflows every single day. Their daily experience is your best shield against costly compliance failures.

Learn More : KKM Approval Malaysia: Legal Requirements for Sellers | Guidelines on Good Distribution Practices for Pharmaceutical Products

Let’s be honest: that beautifully designed product label, the detailed insert, or even your latest campaign visuals? If they haven’t been thoughtfully localized for the Malaysian market, they risk creating an instant disconnect with local consumers. This is especially critical in pharmacy settings across rural and suburban Malaysia, where Bahasa Malaysia is overwhelmingly the preferred language for understanding health and wellness products. Simply translating word-for-word isn’t enough. A genuine lack of understanding about the local market dynamics often leads straight to customer mistrust or outright miscommunication. And that directly hits your bottom line.

Think it won’t happen to your brand? Consider these cautionary tales:

The “Whitening” Backlash: A well-known skincare line proudly promoted its product’s “whitening” benefits. Unfortunately, they completely missed the deep cultural sensitivities surrounding skin tone messaging prevalent in the region. The result? A significant sales drop fueled by local consumer backlash – a costly lesson in cultural awareness.

The Jargon Jungle: An imported supplement brand used dense, technical medical terms exclusively in English on its packaging. Faced with complex terminology they couldn’t grasp, potential customers in Malay-speaking areas became hesitant. The lack of clear comprehension created a barrier to purchase, undermining the product’s potential.

Successfully connecting with consumers in Malay-majority regions requires moving beyond mere logistics. It demands linguistic precision and deep cultural respect. Here’s how to get it right:

Expert-Led Translation: Don’t rely on generic translation services. Crucially, get your Bahasa Malaysia translations meticulously vetted by a local pharmacist or regulatory compliance officer. They ensure accuracy for both meaning and medical appropriateness within the Malaysian context.

Cultural Radar On High Alert: Scrutinize every visual, symbol, and claim. Avoid culturally insensitive imagery or benefit statements that might seem innocuous elsewhere but cause offense or misunderstanding locally. What works globally often flops regionally.

Highlight Local Relevance: Speak directly to the Malaysian experience. Clearly emphasize benefits that resonate, like mentioning suitability for Malaysia’s hot, humid climate (e.g., “sesuai untuk cuaca panas Malaysia” – suitable for Malaysia’s hot weather). This shows you understand their needs.

Ultimately, effective distribution in these vital markets hinges on recognizing that language and culture are inseparable from the product experience itself. Ignoring this reality doesn’t just confuse shoppers – it actively erodes trust and limits your brand’s reach. Getting your labels and messaging culturally tuned isn’t optional; it’s fundamental to building lasting relationships and driving sales in the Malay-speaking heartlands of Malaysia.

Picking the wrong distribution partner for your pharmacy products in Malaysia isn’t just inconvenient – it’s a strategic risk. A poorly chosen distributor can seriously undermine your product’s availability across the country, tarnish the brand reputation you’ve worked hard to build, and effectively stall your market expansion plans dead in its tracks. Let’s be real, many independent distributors simply lack the extensive nationwide network, the deep compliance know-how, or the crucial reach into key retail pharmacies needed to truly thrive in this competitive landscape.

So, how do you spot a distributor that might cause headaches? Watch out for these serious red flags:

Category Confusion: Does the distributor have zero specific experience handling products like yours? Someone used to shifting cosmetics won’t necessarily grasp the complexities of distributing OTC medicines effectively. That mismatch spells trouble.

Weak Retail Links: If they don’t have proven, strong relationships with major Tier-1 pharmacy chains – names like Alpro Pharmacy or Caring Pharmacy come to mind – then getting your products onto those essential shelves becomes a huge uphill battle. That’s a real problem for visibility.

Sloppy Operations: Be wary of distributors with disorganized record-keeping practices or vague, unclear Standard Operating Procedures (SOPs). This lack of structure often leads to errors, delays, and compliance nightmares down the line.

Conversely, a truly high-performing pharmacy wholesale distributor in Malaysia delivers tangible value. They’ll stand out by offering:

Real Transparency: You get clear visibility into how your products perform at retail, with consistent, reliable reporting – no black boxes here. You actually know what’s happening.

Retail Muscle: They provide access to trained merchandisers who actively work the shelves within partner pharmacies, ensuring your products look great and stay stocked. This on-the-ground support is gold.

Critical Capabilities: Essential infrastructure like regulatory expertise for navigating Malaysia’s requirements and robust cold chain logistics (if your products need it) are non-negotiable must-haves they possess.

Before you sign on any dotted line, doing your homework is non-negotiable. Rigorously evaluate their actual track record specifically within the Malaysian pharmacy distribution service sector. Don’t just take their word; insist on seeing detailed outlet performance case studies. Even better? Make the effort to talk directly to brands already working with them. Hearing firsthand experiences offers invaluable insights you simply can’t get from a brochure. Getting this partnership right is fundamental to your success in Malaysia.

Let’s be brutally honest here: securing strong distribution for your healthcare product is only half the battle won. If you’re neglecting strategic pharmacy merchandising, your visibility plummets regardless of how many stores carry you. This becomes absolutely critical within the often chaotic environment of community pharmacies. Picture this: cramped aisles, overflowing shelves, and fierce competition for limited customer attention. Without a deliberate display strategy, even a fantastic product risks becoming invisible dust collectors.

So, what typically goes wrong? Several frequent errors sabotage in-pharmacy performance:

Missing from Prime Real Estate: Failing to secure prominent end-cap placements or dedicated promotional shelf space means customers simply won’t see your product during their shopping journey. It’s buried.

Inconsistent Brand Presentation: When your product looks haphazardly placed or arranged differently in every single store, you lose brand recognition and confuse shoppers. Consistency builds trust.

Uninformed Pharmacy Staff: Pharmacists and technicians are powerful influencers. If they lack clear education on your product’s key benefits and differentiation, they can’t effectively recommend it to customers asking for advice. A huge missed opportunity!

Here’s the uncomfortable truth: your competitors might be outselling you not necessarily because their product is superior, but purely because they’ve mastered making theirs easier to find and more appealing at the crucial point of purchase. Better retail visibility directly translates to more units flying off the shelf.

Ready to fix this? Elevating your pharmacy merchandising requires focused action:

Enforce National Standards with Teeth: Develop clear, brand-specific planograms (visual shelf layouts) for national rollout. Crucially, invest in robust compliance monitoring – through audits or mystery shopping – to ensure stores actually implement them correctly. Consistency is non-negotiable.

Arm Pharmacies with Display Tools: Make it effortless for busy staff. Provide display-ready shipping cases that convert instantly into attractive shelf units. Supply eye-catching wobblers, shelf talkers, and other point-of-sale materials designed specifically for the pharmacy environment to grab shopper attention immediately.

Empower Your Field Teams: Don’t just drop off materials. Train your field sales representatives thoroughly. Their role must evolve to include actively maintaining optimal shelf share, ensuring planogram adherence during visits, setting up promotional displays properly, and quickly resolving any merchandising issues they spot. They’re your frontline merchandising army.

Ultimately, optimizing how your product looks and where it sits on the pharmacy shelf isn’t merely about aesthetics – though that matters. It’s a fundamental driver of actual sales velocity. Smart, consistent, well-supported merchandising cuts through the clutter. It captures attention, builds brand presence, leverages staff influence, and directly impacts your bottom line by turning passive shelf placement into active, off-the-shelf selling. Which outcome are you actually investing in?

Learn More : Wholesale merchandising services malaysia

Ever walk into one pharmacy only to find empty shelves where your essential item should be, while another location seems to have a mountain of the same product gathering dust? This frustrating imbalance – pharmacies drowning in excess inventory while others face constant, sales-killing shortages – is a widespread headache in distribution. Often, the silent culprit lurking behind this chaos is surprisingly fundamental: ineffective demand forecasting.

Many independent distributors, pressed for time and resources, fall back on outdated habits. Relying purely on rigid, calendar-based ordering cycles or vague intuition (“We think we’ll need more next month”) simply doesn’t cut it in today’s dynamic market. True inventory optimization demands a much sharper approach. It requires harnessing real-time sales data, developing a keen understanding of seasonal buying surges and dips, and implementing sophisticated SKU-level forecasting to predict precisely what specific products will be needed, where, and crucially, when.

Consider this telling local scenario: A popular wellness brand launched a new probiotic line. During the busy Ramadan period, outlets across the Klang Valley experienced a complete sell-out – fantastic demand! Yet, simultaneously, identical products sat untouched on shelves in East Malaysia, representing pure lost opportunity and tied-up capital. What went wrong? A critical failure in location-specific forecasting. The distributor likely treated the entire country as a single, uniform market, ignoring vastly different regional purchasing rhythms and localised events. The result? Painfully imbalanced stock levels, missed sales where demand was hot, and wasteful overstock where it was cold.

Repeating these costly mistakes is avoidable. Distributors can build far more resilient and profitable supply chains by adopting these core strategies:

Listen to Your Data’s Story: Stop guessing. Actively analyze past sell-through rates meticulously. This historical performance isn’t just a record; it’s the most reliable indicator for shaping your monthly restocking decisions. Identify trends, slow-movers, and consistent winners.

Think Hyper-Locally: Malaysia’s diversity is its strength – and a forecasting challenge. Factor in regional festivities, school holidays, local economic conditions, and even climate variations. What sells briskly in Penang during Chinese New Year might see zero movement in Kuching. Granularity is key.

Embrace Digital Power: Manual spreadsheets won’t suffice for modern complexity. Integrate dedicated digital forecasting tools or leverage advanced analytics capabilities offered by your pharmacy distribution service in Malaysia. These systems process vast amounts of data (sales history, seasonality, promotions, market trends) to generate accurate, SKU-specific predictions for each location.

Ultimately, the path to smoother operations and maximized sales is clear: Invest in superior forecasting to achieve flawless fulfillment. By replacing guesswork with data-driven intelligence and acknowledging regional nuances, distributors can finally conquer the twin demons of overstock and stockouts, ensuring the right products reach the right pharmacies at precisely the right time. Isn’t it time your inventory worked smarter?

Learn More : Supply Chain 4.0 – the next-generation digital supply chain

Ever pause to wonder if that bottle of eye drops or expensive serum actually stayed cold all the way from the warehouse to the shelf? For temperature-sensitive pharmaceuticals like injectables, serums, and certain eye care products, consistent cold storage isn’t just a suggestion—it’s absolutely critical for maintaining their potency and safety. Yet, surprisingly often, the cold chain within pharmacy supply chains gets compromised, putting product integrity and patient trust on the line.

Here’s the uncomfortable truth: while many pharmacy logistics providers in Malaysia (and elsewhere!) advertise “refrigerated transport,” the reality can be alarmingly different. Too frequently, the solution involves basic cool boxes packed with ice packs. Sounds okay? The problem is, these manual methods are notoriously unreliable over longer journeys or during delays. Temperatures can easily creep upwards without anyone realizing it until it’s too late, degrading sensitive formulations long before the product reaches the consumer.

Consider the case of a well-known dermaceutical brand. They suddenly faced a wave of customer complaints questioning their flagship serum’s effectiveness. Digging deeper revealed a disturbing pattern: multiple retail outlets were storing the product at ambient temperatures, sometimes exceeding 30°C! This uncontrolled heat exposure directly broke down the serum’s active ingredients, rendering it far less effective. The brand’s reputation took a significant hit, alongside the financial sting of handling returns and replacements.

So, how do you prevent becoming the next cautionary tale? Proactive measures are essential:

Choose Tech-Savvy Logistics Partners: Move beyond basic claims. Partner with providers who offer verifiable temperature logs and utilize IoT tracking devices for real-time monitoring throughout transit. This transparency is non-negotiable.

Educate Your Retail Network: Don’t assume every pharmacy counter staff member knows the specific storage needs for every SKU. Provide clear, ongoing education and enforce strict protocols regarding refrigerated storage requirements for sensitive items.

Empower the Package Itself: Incorporate smart solutions like temperature monitoring labels or QR codes for verification directly on product packaging. This gives everyone in the chain—and even the end customer—visible proof that proper temperatures were maintained.

Ignoring temperature control isn’t just a quality lapse; it’s a direct path to eroding customer trust and facing a flood of costly returns. When medicines or high-value skincare lose their efficacy due to heat exposure, the damage to your brand’s credibility can be severe and lasting. Investing in a truly robust, monitored cold chain isn’t an expense; it’s fundamental protection for your product’s integrity and your company’s reputation in the competitive pharmacy landscape. Make sure the cold chain isn’t broken on your watch.

Learn More : Securing Trust in the Global COVID-19 Supply Chain

![]()

We’ve all heard the adage: “What gets measured gets improved.” It’s undeniably true, especially in the competitive world of pharmacy distribution across Malaysia. Yet, surprisingly, many brands overlook fundamental Key Performance Indicators (KPIs), creating dangerous blind spots in their execution strategy. Simply put, if you aren’t rigorously tracking your distribution performance, you genuinely won’t know whether your core strategy is effective… until it’s far too late to make impactful corrections. That lag can mean lost sales, wasted resources, and frustrated retail partners.

For pharmacy businesses operating within Malaysia’s unique market, focusing on several essential metrics is absolutely critical. These aren’t just numbers; they’re vital signs indicating the health of your product’s journey to the consumer. Key amongst them are:

Sell-Through Rate per Outlet: How quickly is your product actually moving off the shelves at each specific pharmacy location? This cuts through shipment data to reveal real consumer demand.

On-Shelf Availability (OSA) Score: Is your product physically present and easy for customers to find when they walk in? Consistently low OSA directly translates to missed sales opportunities.

Delivery Lead Time Compliance: Are your shipments consistently arriving at pharmacies within the promised timeframe? Reliability builds trust and prevents stockouts.

Rate of Return or Wastage: How much unsold product is coming back, or worse, expiring on shelves? High rates signal inefficiency and directly hit your bottom line.

Investing in robust wholesale distribution analytics delivers powerful advantages beyond basic tracking. High-performing analytics platforms empower you to pinpoint specific pharmacy outlets struggling with sales support – maybe they need better training or merchandising. They can identify crucial gaps in promotion timing, ensuring your marketing spend aligns perfectly with actual market activity. Ultimately, this granular insight is invaluable for guiding the strategic realignment of your entire marketing mix for maximum impact.

Waiting for cumbersome year-end reports is a recipe for stagnation in today’s fast-paced environment. The solution? Implementing dynamic, real-time performance dashboards alongside structured monthly scorecards. This combination provides the timely visibility and actionable intelligence needed to proactively optimize your distribution, maximize sales potential, and stay ahead within Malaysia’s vibrant pharmacy sector. Don’t let blind spots dictate your results; measure what matters and watch performance improve.

Learn More : Key Performance Metrics to Evaluate Pharmacy Distribution Services in Malaysia

Getting your product onto pharmacy shelves is just the beginning. If your field representatives and pharmacists aren’t fully aligned and enthusiastic, even the best distribution strategy falls flat. Genuine pharmacy collaboration isn’t optional; it’s the absolute cornerstone for building essential consumer awareness and trust, particularly when launching new SKUs into a crowded marketplace. Ignoring this critical relationship guarantees your product gathers dust, not customers.

So, what frequently derails this vital partnership? Several key communication failures consistently emerge:

The Rep-Pharmacist Disconnect: Brand representatives sometimes operate in a bubble, failing to establish open lines of communication with the actual pharmacists interacting with customers daily. This gap means crucial messaging gets lost.

Silence on the Shelf: Field teams visiting stores might notice empty shelves or poorly executed displays, yet this critical information often isn’t systematically reported back to headquarters. Out-of-stocks and visibility problems persist unseen.

The Missing Feedback Loop: Perhaps most damaging is the absence of a structured system to gather insights directly from pharmacists or overheard customer comments within the store. These frontline observations are pure gold for understanding real-world barriers and perceptions.

The solution requires proactive, structured engagement:

Empower Through Knowledge: Don’t assume pharmacists know your product’s unique benefits. Provide concise, monthly product updates and targeted training sessions – not just for pharmacists, but for merchandisers and store staff too. Equip them to effectively answer customer questions and champion your brand. Make it relevant to their challenges.

Visibility & Verification: Implement a regular schedule of bi-weekly store audits. These shouldn’t be just checklists; require photos documenting actual conditions – shelf placement, stock levels, promotional compliance. Combine this visual evidence with structured feedback from the field team and store personnel. It’s about verifying execution and identifying friction points.

Real-Time Coordination: Leverage technology for seamless field team coordination. Dedicated WhatsApp groups or other digital communication platforms enable instant reporting of issues like stockouts, competitor activity, or display opportunities, allowing for much faster resolution than traditional reporting chains allow.

Remember this: Your most valuable, actionable insights almost always originate on the ground – from pharmacists hearing customer hesitations and field reps seeing execution realities. Building robust systems to capture, share, and act on this frontline intelligence isn’t just helpful; it’s fundamental to driving product movement and long-term success within the competitive pharmacy channel. Don’t let these golden opportunities slip away due to poor communication. Your pharmacists are your frontline intelligence network – engage them properly.

Learn More : Building a Collaborative Enterprise

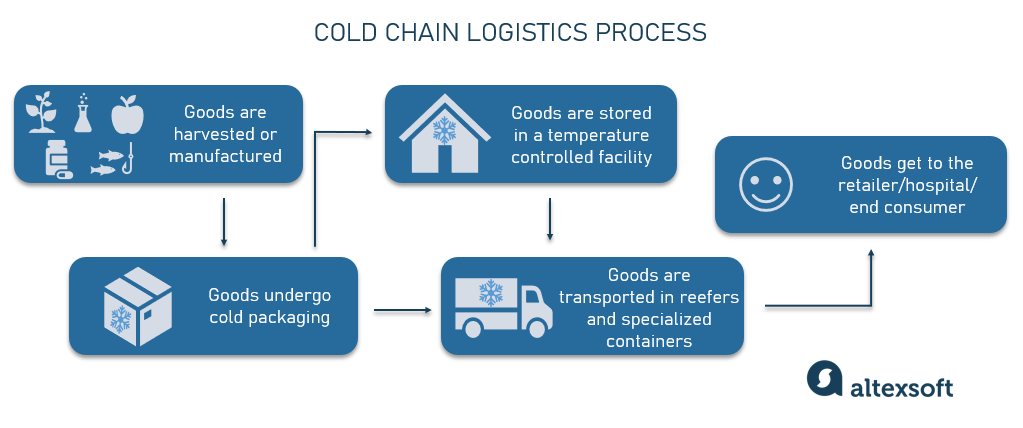

Navigating pharmacy distribution across Malaysia and other Malay-speaking regions presents unique complexities. It’s about far more than just moving products from point A to point B. True success demands a trifecta: operational precision, genuine cultural empathy, and sharp local market intelligence. As industry experience shows, seemingly small missteps—like overlooking critical cold chain requirements or partnering with a distributor pharmacy that isn’t the right strategic fit—can lead to significant negative outcomes. These range from product spoilage and regulatory fines to damaged brand reputation and lost sales.

However, the flip side is equally compelling. By proactively avoiding these common pitfalls, pharmaceutical brands unlock powerful advantages: notably enhanced shelf visibility where it counts, the crucial building of strong consumer trust within local communities, and ultimately, a demonstrably higher return on investment (ROI).

So, how do you actually win in Malaysia’s dynamic and competitive pharmacy sector? Consider these foundational strategies:

Regulatory Mastery is Non-Negotiable: Deeply understanding and consistently adhering to Malaysia’s specific pharmaceutical regulations isn’t optional; it’s the bedrock of sustainable operations. Compliance must be woven into your core strategy.

Partner with Purpose: Choosing distribution partners goes beyond basic capability. You need collaborators whose values, market approach, and long-term vision genuinely align with your own brand goals and commitment to quality.

Focus on Visibility, Planning & Teamwork: Prioritize robust demand forecasting, ensure your products are consistently visible and available at the retail level, and foster a spirit of open collaboration with all partners along the supply chain. This integrated approach prevents costly stockouts and maximizes reach.

Whether your brand is a well-established player or just setting foot in the vibrant Malaysian market, there’s always opportunity to refine and strengthen your distribution approach for better results.

If your goals include building a more resilient and profitable pharmacy distribution strategy across Malaysia, sidestepping expensive errors, or elevating your merchandising and retail execution services, connecting with PriooCare is your next strategic move.

Our dedicated team possesses deep expertise in delivering comprehensive, full-spectrum pharmacy distribution solutions specifically designed for the Malaysian landscape and broader Malay-speaking markets. We go beyond simple logistics to offer vital compliance support, expert retail execution ensuring your products shine on-shelf, and targeted sales optimization strategies.