May 22, 2025

Malaysia’s pharmacy sector—from major retail chains like Guardian to neighborhood drugstores—faces a constant influx of new health and wellness products. While securing shelf placement remains a priority for brands, today’s fast-moving retail environment demands far more than basic visibility. With shrinking consumer attention spans and overcrowded aisles, innovative merchandising has become the ultimate differentiator for product launches.

For distributors and brand managers, success hinges on treating merchandising as a core growth strategy rather than an afterthought. Shelf space alone won’t guarantee sales if products fail to engage shoppers the moment they walk in. This is where Malaysia’s fragmented pharmacy distribution networks—from regional independent suppliers to large-scale wholesale operators—become pivotal. Choosing partners with local market expertise or nationwide reach can determine whether a product launch fizzles or thrives.

Tailored merchandising solutions are no longer optional. Think eye-catching displays near checkout counters, bundled promotions aligned with seasonal health trends, or digital screens explaining product benefits. These tactics work best when aligned with the unique strengths of your distribution partner. Independent distributors often excel at hyper-local campaigns, while national wholesalers can synchronize launches across hundreds of stores simultaneously.

Another overlooked factor? Staff engagement. Pharmacies with trained personnel who actively recommend products create lasting impressions. Collaborating with distributors who prioritize retailer training programs ensures your innovation doesn’t get lost in the noise.

Ultimately, winning in Malaysia’s pharmacy landscape requires merging strategic partnerships with customer-centric merchandising. By combining data-driven shelf placement, creative in-store activations, and distributor expertise, brands can transform fleeting interest into loyal repeat purchases.

This piece examines how Malaysia’s multifaceted pharmacy distribution ecosystem—when leveraged thoughtfully—enables brands to cut through the clutter. From localized campaigns to tech-enhanced displays, discover approaches that turn new products into must-stock essentials for retailers and must-buy solutions for consumers. After all, in a market where 43% of shoppers decide what to purchase while browsing, merchandising isn’t just about visibility—it’s about creating unignorable moments.

Malaysia’s vibrant pharmacy sector presents unique opportunities—and challenges—for brands aiming to launch new products. With a retail ecosystem split between national chain giants like Watsons and Caring, and community-focused independent pharmacies, success hinges on understanding these dual channels. Chain stores offer expansive reach through hundreds of outlets, but independents counter with localized influence and stronger patient relationships. This duality shapes how products are marketed, stocked, and perceived across the country.

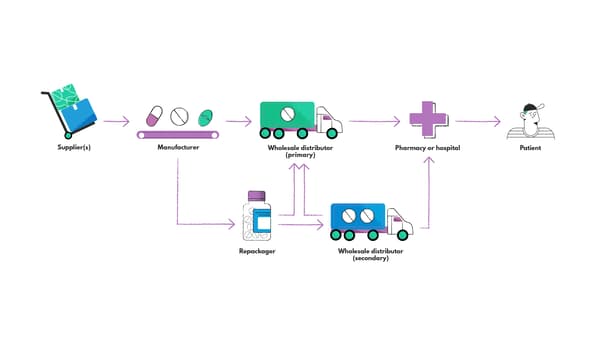

Central to bridging this divide are pharmacy distributors, who act as vital connectors between manufacturers and retailers. These intermediaries handle everything from regulatory paperwork to in-store promotions. Independent distributors often shine in crafting tailored campaigns for niche markets, while large-scale wholesalers focus on logistics efficiency and broad geographic coverage. Their combined efforts ensure products not only reach shelves but also capture consumer attention in a crowded market.

Yet the path to market entry isn’t without hurdles. Regulatory approvals from agencies like the MDA/NPRA can stall timelines, especially for health supplements or novel formulations. Even after compliance checks, brands face fragmented execution of point-of-sale materials (POSM)—posters or displays might appear inconsistently across smaller chains. Add to this the reality of limited shelf space, particularly in compact urban outlets, and the competition for visibility becomes fierce.

To thrive, brands must partner with distributors that balance agility with strategic muscle. Prioritizing partners who streamline compliance processes can mitigate delays, while those offering merchandising support ensure cohesive branding from Kuala Lumpur to rural Kelantan. For independents, leveraging distributors skilled in hyper-local engagement—think community health talks or loyalty programs—can deepen trust. Meanwhile, chains may require data-driven promotions aligned with seasonal demand.

Ultimately, standing out in Malaysia’s pharmacy landscape demands more than just a quality product. It requires a distributor strategy that harmonizes regulatory savvy, retail relationships, and adaptive marketing—a trifecta that turns logistical challenges into competitive advantages. By aligning with partners who grasp both the scale of chains and the nuance of independents, brands can secure not just shelf space, but lasting customer loyalty.

Learn more : Affordable Pharmacy Distribution Solutions for Small Pharmacies and Clinics in Malaysia | How Does the Pharmaceutical Supply Chain Work?

In Malaysia’s bustling pharmacy retail scene, where shoppers often make split-second health decisions, standing out requires more than just a quality product. The difference between a breakout success and a forgotten shelf item? Strategic visual merchandising that taps into human psychology.

Imagine walking into a pharmacy: shelves overflow with options, but only a few products command attention. Here’s the secret—product placement isn’t random. Eye-level positioning dominates as the prime real estate, capturing 70% of shopper focus. Items placed here not only attract glances but subconsciously signal legitimacy. Combine this with emotional trust markers—like “pharmacist-recommended” tags or “clinically tested” badges—and you create instant credibility. In a market where skepticism runs high, these cues shortcut decision-making, especially for health-conscious Malaysians.

But visibility alone isn’t enough. Modern shoppers crave reassurance before purchasing. Enter trial enablers: testers, infographics showing before/after results, or QR codes linking to demo videos. These tools transform passive browsing into active engagement. For instance, a skincare serum with visible hydration claims (think plump, dewy skin visuals) or a cholesterol supplement paired with a 30-day challenge pamphlet can spark curiosity and reduce perceived risk.

Crucially, pharmacist endorsement remains a gold standard. Training staff to advocate products through in-store samples or consultations builds organic trust. When a pharmacist hands a customer a trial-sized acne cream and explains its benefits, it’s not just a sale—it’s a relationship starter.

However, many brands stumble by treating merchandising as an afterthought. A science-backed moisturizer buried between outdated stock-keeping units (SKUs) will struggle, no matter its efficacy. Successful launches blend localized launch marketing strategies—think O+O (online + offline) campaigns or influencer partnerships with Malaysian healthcare pros—with tactical in-store storytelling.

Ultimately, smart merchandising isn’t about aesthetics; it’s a conversion engine. By aligning psychology-driven displays with Malaysia’s fast-paced retail rhythms, brands can turn fleeting interest into loyal repeat buys. After all, in a crowded aisle, the product that feels trustworthy and accessible wins—every single time.

Learn more : What to Expect in US Healthcare in 2025 and Beyond | Understanding Consumer Behavior and Insights

Breaking into Malaysia’s bustling pharmacy retail scene demands more than just stocking a product and hoping for the best. With shoppers bombarded by choices, strategic in-store tactics are non-negotiable for cutting through the noise. Here’s what leading chains are doing to ensure new launches grab attention—and keep it.

Human eyes naturally gravitate toward items positioned at eye level (120–150cm). Products placed in this “golden zone” consistently outperform those on higher or lower shelves. It’s a simple but often overlooked detail that can dramatically boost visibility.

Brightly colored shelf talkers with bold phrases like “Just Launched” or “Dermatologist Approved” act as mini billboards. These small signage flags interrupt browsing patterns, encouraging customers to pause and engage.

End-cap displays—those coveted corner spaces at aisle ends—are prime for showcasing new items. Studies show these setups can triple product visibility compared to standard shelf placements. Use them to create themed displays or highlight limited-time offers.

Cross-merchandising taps into logical customer needs. Position a vitamin C serum near sunscreen, or bundle baby shampoo with diaper rash cream. This not only boosts basket size but also helps shoppers visualize product benefits in real-life scenarios.

QR codes linking to demo videos, wobblers with discount claims, or testers for tactile engagement—these point-of-sale materials (POSM) bridge the gap between curiosity and purchase. They’re particularly effective for complex items like medical devices or specialty supplements.

Timing matters. Rolling out these tactics during the critical 6-8 week launch window, especially through established pharmacy distributor networks, can cement a product’s presence. When executed well, the impact ripples beyond initial promotions, creating sustained shelf authority.

The key lies in layered execution: combine shelf placement with signage, pair complementary products, and use interactive elements to educate. For brands willing to invest in this multipronged approach, Malaysia’s pharmacy aisles offer ample room to stand out—and stay relevant.

In Malaysia’s competitive pharmacy retail landscape, choosing the right distribution partner isn’t about logistics alone—it’s about securing a strategic ally who amplifies your brand’s visibility. A distributor’s role transcends moving inventory; they shape how effectively your product gains traction in crowded retail environments. Here’s what separates exceptional partners from basic vendors when launching in Malaysia.

Three Non-Negotiables for Distribution Success

Strategic POSM Execution

A strong partner ensures point-of-sale materials (POSM) aren’t just delivered but strategically placed to maximize customer attention. Think shelf wobblers positioned at eye level or counter displays near high-traffic zones. This requires distributors to understand store layouts and consumer behavior patterns unique to Malaysian pharmacies.

Active Pharmacy Team Collaboration

Launch success often hinges on staff buy-in. Leading distributors facilitate hands-on collaboration with pharmacy teams during critical launch weeks—training staff on product benefits or arranging incentive programs. For example, skincare brands targeting therapeutic audiences benefit from partners connected to chains like Alpro Pharmacy, where pharmacists actively educate customers.

Real-Time Sales Transparency

Reliable partners provide granular sell-through data, not just shipment updates. Access to real-time metrics like stock turnover rates or regional performance gaps allows brands to adjust campaigns swiftly.

Independent distributors excel for niche or first-to-market products, offering tailored service and agility. Conversely, established pharmacy wholesale networks deliver speed and scale for brands prioritizing nationwide shelf penetration. The choice depends on whether your launch strategy prioritizes precision or mass reach.

A common launch mistake? Marketing teams planning promotions in isolation from distribution realities. Jointly mapping advertising spends with your partner ensures campaigns align with in-store execution capabilities. Misaligned budgets often result in glossy social media ads for products buried on bottom shelves.

Malaysia’s pharmacy sector rewards brands who treat distributors as extensions of their commercial team—not just vendors. The right partner bridges the gap between your brand’s promise and the retail reality, turning logistical support into a competitive edge.

Learn more : Top 10 Pharmacy Merchandising Service Providers in Malaysia

In Malaysia’s bustling pharmacy retail landscape, a product’s triumph often hinges on how well frontline teams—from pharmacists to sales associates—can advocate for it. While branding and advertising generate awareness, it’s the in-store interactions that convert curiosity into sales, particularly in health-centric segments like supplements or skincare.

For staff to become effective product champions, brands must prioritize targeted training and tangible resources. Hands-on demonstration kits, for instance, are invaluable for categories where tactile engagement matters. Picture a skincare launch where staff can showcase texture or absorption rates directly to customers. Similarly, strategic sampling campaigns in 20–30 high-traffic flagship stores can amplify visibility, creating localized buzz that ripples through communities.

Visual training tools also play a pivotal role. Compact A5 reference cards distilling key benefits, FAQs, and rebuttals empower staff to communicate confidently without memorizing dense manuals. These aids bridge knowledge gaps while keeping messaging consistent across outlets.

A recent Guardian Malaysia collagen launch underscores this approach. By pairing pharmacist-led demos with portable trial kits, the brand achieved a 40% sell-through rate within two weeks—a figure that outpaced category benchmarks. The strategy succeeded because it merged staff expertise with customer-centric experimentation, turning complex science into relatable benefits.

However, even the best tactics falter without measurable goals. Collaborating with Malaysia’s pharmacy distribution networks to track metrics like trial-to-purchase ratios or staff compliance rates ensures accountability. These partnerships provide granular insights, allowing brands to refine strategies in real time. For example, if sampling drives footfall but not conversions, tweaks to staff scripting or product positioning can follow swiftly.

Ultimately, preparing store teams isn’t just about checklists—it’s about fostering a culture where staff feel informed, motivated, and equipped to translate product potential into customer solutions. In a market where trust is currency, that human connection remains the ultimate differentiator.

When launching new products in Malaysia’s competitive pharmacy sector, having clear metrics isn’t just helpful—it’s non-negotiable. Without quantifiable benchmarks, even the most creative merchandising efforts risk becoming expensive experiments. To avoid guesswork, brands must identify key performance indicators (KPIs) early and collaborate with partners who prioritize measurable outcomes.

Core Indicators to Track

Product Turnover Velocity: Measure weekly unit sales per store to assess how quickly inventory moves. This metric highlights whether shelf placements or promotions resonate with shoppers. High turnover suggests strong demand alignment, while sluggish numbers may signal pricing issues or poor visibility.

Revenue Growth Comparison: Analyze sales data before and after merchandising campaigns. A sustained 15-20% increase over baseline figures, for instance, indicates effective tactics. Seasonal fluctuations should be accounted for to isolate the impact of your strategy.

Compliance with Visual Standards: Track how consistently point-of-sale materials (POSM) like posters, shelf talkers, or display units are implemented across outlets. If only 60% of stores follow guidelines, your brand’s visibility—and sales potential—are compromised.

Staff Engagement Insights: Pharmacist and store manager feedback is gold. Structured surveys or quick digital forms can reveal on-the-ground challenges, like confusing product messaging or stock shortages, that raw sales data might miss.

Leading pharmacy distribution partners in Malaysia differentiate themselves through transparency. Opt for services offering live dashboards or weekly summaries detailing the above metrics. If your current provider shares vague reports or lacks tracking systems, it’s time to rethink the partnership. Real-time insights let brands tweak campaigns mid-flight—say, boosting POSM audits if compliance dips or adjusting inventory allocations based on turnover trends.

Without these metrics, brands risk pouring budgets into strategies that look good on paper but fail to drive shelf-level results. Remember: In fast-moving retail environments, agility hinges on data. Partner with distributors who treat your merchandising investment as a science, not a gamble.

Navigating Malaysia’s pharmacy retail sector requires precision—yet many brands stumble by overlooking foundational merchandising principles. While digital campaigns and product innovation grab attention, poor execution at the shelf level often derails even promising launches. Let’s explore common missteps that compromise market entry success.

Relying solely on digital ads without synchronized physical visibility is a recipe for lost sales. Imagine customers intrigued by online promotions but unable to spot products in-store due to absent displays or signage. This disconnect between virtual interest and real-world accessibility remains a widespread oversight.

Brands frequently assume promotional materials (POSM) reach every outlet, but rural pharmacies often face delays or exclusions. When point-of-sale assets fail to arrive, products blend into crowded shelves, losing their competitive edge. Regular audits with distributors can prevent these gaps.

Packaging that lacks contrast with neighboring items creates an invisibility cloak. If your SKU doesn’t “pop” against competitors’ designs, shoppers’ eyes will glide past it. Invest in bold color schemes or unique shapes tailored to Malaysia’s diverse retail environments.

Chasing quantity over quality—like prioritizing 50 small stores without uniform branding—dilutes impact. Fragmented listings confuse consumers and weaken brand recall. Focus instead on securing prominent placements in key urban hubs before expanding outward.

Treating merchandising as a checkbox task rather than a growth driver leads to inconsistent visibility. Brands that skip post-launch reviews with pharmacy partners risk uneven execution, leaving sales potential untapped. Regular alignment ensures displays remain fresh and compliant with chain-specific guidelines.

In Malaysia’s competitive pharmacy landscape, success hinges on bridging digital strategies with tactile retail experiences. Avoid treating merchandising as an afterthought—it’s the bridge between consumer interest and purchase decisions. As retail trends evolve, brands that master this balance will secure lasting shelf presence. After all, a product that can’t be seen is a product that won’t sell—no matter how innovative it is.

Malaysia’s retail pharmacy landscape is undergoing a quiet revolution as innovative brands harness cutting-edge technologies to cut through the noise. With blurred lines between digital and physical shopping experiences, forward-thinking companies are adopting intelligent merchandising strategies that blend data precision with customer-centric creativity.

Four Innovations Reshaping Retail Success

Dynamic Digital Pricing Systems

Gone are the days of manually updating sale stickers. Cloud-connected displays now allow synchronized price updates across all stores within minutes—a crucial advantage when running time-sensitive promotions on allergy medications or seasonal health products.

Augmented Reality Education

Savvy brands are solving the “information gap” through smartphone-activated AR experiences. Shoppers scanning vitamin bottles might see 3D visualizations of nutrient absorption processes—a tactic that builds trust while reducing reliance on overworked pharmacy staff.

Predictive Shelf Intelligence

Advanced algorithms now analyze both historical sales patterns and real-time foot traffic to recommend product placements. This isn’t just about eye-level positioning; some systems factor in cultural preferences, like grouping postnatal supplements near traditional confinement care products in majority-Malay neighborhoods.

Alliance-Driven Commerce

A growing number of Malaysia pharmaceutical distributors now function as growth partners, offering bundled services that combine logistics with localized marketing campaigns—proving particularly valuable for foreign brands navigating Malaysia’s complex regulatory and cultural landscape.

Early adopters are seeing measurable returns. Consider the case of a homegrown digestive health brand that integrated AI-driven shelf analytics during their probiotic launch. By adjusting display densities in high-traffic urban stores while prioritizing educational content in suburban outlets, they achieved a 28% sales lift within six weeks—a testament to hyper-localized execution.

These technologies—when implemented early—provides more than just short-term spikes. They create feedback loops where customer behavior data refines inventory decisions and campaign messaging. For market entrants in Malaysia’s pharmacy sector, the playbook is clear: blended digital-physical strategies that address both logistical efficiency and human curiosity will separate tomorrow’s industry leaders from transient participants. The window for gaining this edge? It’s narrowing faster than most realize.

Learn more : Key Trends Shaping Pharmacy Merchandising Services in Malaysia | The Future of Retail Pharmacies: From Filling Scripts to Fulfilling Needs

In Malaysia’s fast-evolving retail environment, pharmacy merchandising has shifted from a passive afterthought to a non-negotiable driver of success. With consumers navigating crowded aisles and endless options, every detail—from selecting the ideal distribution partner to designing eye-catching displays—directly influences whether your product gains traction or fades into obscurity. Brands that harmonize merchandising excellence with targeted staff training and agile distribution systems don’t just enter the market—they dominate it.

The stakes are higher than ever. Whether you’re collaborating with specialized independent distributors for niche markets or leveraging nationwide pharmacy wholesale networks, seamless coordination between stakeholders separates fleeting wins from sustained growth. It’s not just about securing shelf space—it’s about creating an ecosystem where your product remains visible, accessible, and top-of-mind for both retailers and shoppers.

Consider this: A strategically placed display can boost impulse purchases, while poorly trained staff might miscommunicate your product’s unique benefits. Meanwhile, inconsistent distribution risks stockouts that erode consumer trust. The solution lies in a unified approach—one that aligns your brand’s goals with the operational strengths of your chosen distributors. For emerging brands, this might mean partnering with agile regional distributors attuned to local preferences. For established players, it could involve optimizing logistics with large-scale wholesalers to ensure nationwide availability without compromising merchandising quality.