August 3, 2025

What’s the secret behind Malaysian pharmacies maintaining relevance amid today’s cutthroat retail environment? More often than not, success hinges on partnering with distribution experts who align with modern demands. As we move through 2025, the pharmacy supply chain in Malaysia has transformed into a high-stakes arena shaped by digital innovation, stricter NPRA guidelines, and shifting shopper expectations. Between rising competition from retail chains, niche independents, and even e-commerce platforms, distributors now play a make-or-break role in determining a pharmacy’s operational agility and market reach.

From navigating complex compliance frameworks to adapting to real-time inventory demands, pharmacies face pressure to balance speed, accuracy, and cost-efficiency. Whether collaborating with regional distributors specializing in personalized service or leveraging nationwide wholesalers with tech-driven logistics, the choice of partner directly influences everything from shelf stockouts to regulatory audits. Meanwhile, consumer preferences are evolving faster than ever—think personalized health products, eco-friendly packaging, and instant delivery options—forcing distributors to innovate or risk obsolescence.

This deep dive explores how Malaysia’s top pharmacy distributors are rewriting the rulebook in 2025. We’ll analyze market shifts, from emerging startups disrupting traditional models to established players investing in AI-powered forecasting tools. You’ll also discover growth strategies for pharmacies, including how to identify distributors offering niche product portfolios, seamless compliance support, or data-driven insights for inventory optimization. Key themes? Agility matters, transparency is non-negotiable, and partnerships built on shared values outperform transactional relationships every time.

Stay tuned as we unpack the trends, challenges, and untapped opportunities defining Malaysia’s pharmacy distribution sector this year—and what it means for your business’s bottom line.

Learn More : Malaysia’s Pharmaceutical Industry: A Fast-Growing Force

Ever wondered how medications reach pharmacy shelves across Malaysia? The pharmaceutical distribution network operates like a precision-engineered machine, ensuring lifesaving products arrive safely from factories to patients. Let’s explore this complex system that keeps Malaysia’s healthcare running smoothly.

The supply chain begins with licensed manufacturers and importers producing or bringing medications into the country. Authorized distributors then take charge – these specialized companies handle temperature-sensitive transportation (critical for vaccines and biologics), secure warehousing, and mountains of regulatory paperwork. From these logistics hubs, products flow to retail pharmacies, hospital networks, and increasingly, digital health platforms serving tech-savvy consumers.

Manufacturer Partnerships

This layer includes global pharmaceutical giants, local generic drug producers, and makers of health supplements or cosmetic-grade medicinal products. Each requires customized handling – what works for aspirin tablets won’t suit injectable antibiotics.

Retail Gateway Challenges

Distributors navigate strict NPRA regulations and international Good Distribution Practice (GDP) standards here. Tasks range from maintaining climate-controlled storage to creating promotional displays for new product launches. One missed temperature check could compromises an entire shipment.

Corporate Direct Channels

Major international brands sometimes bypass traditional distributors, using dedicated sales teams to supply retail chains directly. This model offers greater control over product positioning and brand messaging.

Logistics Revolution

Independent distributors increasingly partner with third-party specialists to conquer last-mile challenges. These collaborations improves access in rural areas through optimized delivery routes and real-time shipment tracking.

Malaysia’s Ministry of Health and NPRA enforce rigorous oversight. Distributors must maintain detailed records tracing every product batch, submit to random audits, and renew licenses annually. Recent updates now cover emerging sectors like online pharmacy marketplaces, proving the system adapts as healthcare evolves.

Understanding this intricate network highlights why proper medication handling matters – every step ensures the drugs you rely on remains safe and effective. From factory to fingertips, it’s a symphony of coordination that keeps Malaysia healthy.

In Malaysia’s fragmented pharmacy retail environment, selecting the right distribution partner can make or break a business. With diverse operational demands across independent stores, hospital networks, and niche markets, understanding distributor capabilities becomes critical. Here’s a breakdown of three primary models shaping pharmaceutical growth:

1. Agile Independent Distributors

Ideal for emerging brands and specialized products, these nimble operators excel at customized solutions. Unlike bulk-focused competitors, they prioritize rapid stock replenishment, hyper-localized marketing material execution, and hands-on retailer support. Their adaptability proves invaluable for time-sensitive product launches or regional pilot programs, particularly in underserved areas where large distributors may lack granular reach.

2. Nationwide Wholesale Networks

Dominating the high-volume sector, these logistics powerhouses cater to chain pharmacies, government contracts, and institutional buyers. Their strengths stem from countrywide warehousing networks, multi-temperature transport fleets, and bulk purchasing discounts. For established brands requiring consistent shelf presence across hundreds of locations, these distributors minimize stockouts through advanced inventory algorithms and centralized quality control systems.

3. Compliance-Focused Niche Experts

When handling regulated categories like biologics, cosmeceuticals, or Schedule poisons, specialized distributors become non-negotiable. These firms combine GDP-certified cold storage with regulatory navigation services—from NPRA product registrations to import permit coordination. Many also provide audit readiness programs, helping pharmacies maintain compliance as Malaysia’s healthcare regulations evolve.

Pharmacies prioritize distributors based on core needs:

Speed-to-market demands lean toward independents offering 72-hour restocking and flexible MOQs

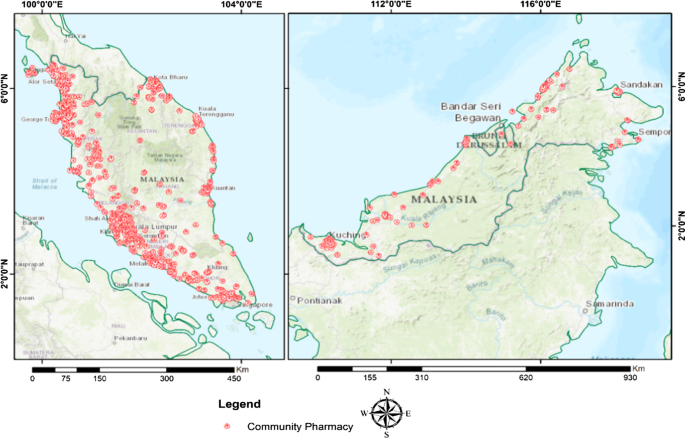

Pan-Malaysia coverage requires wholesalers with East/West Malaysia cross-border expertise

High-risk products necessitate specialists with ISO-classified facilities and compliance track records

Interestingly, hybrid approaches are gaining traction. Some wholesalers now subcontract niche distributors for regulated product lines, while tech-savvy independents adopt warehouse management platforms to compete on scalability. As market dynamics shift, the distributors thriving are those balancing specialization with strategic partnerships—a lesson pharmacies themselves might emulate.

Key takeaway? There’s no universal “best” model, but rather optimal alignments between a pharmacy’s growth phase, product mix, and regulatory exposure. Brands often uses a tiered approach, blending national distributors for core SKUs with specialists for high-margin regulated items. By mapping distributor strengths to specific business objectives, Malaysian pharmacies can turn fragmentation from a challenge into a strategic advantage.

Malaysia’s pharmaceutical sector is rapidly evolving, driven by logistics providers that ensure life-saving products reach hospitals, clinics, and consumers efficiently. This article explores five leading pharmacy distributors reshaping the industry through expansive networks, regulatory compliance, retail dominance, and cutting-edge innovations. (Note: Rankings reflect operational scale, not paid endorsements.)

1. PriooCare Malaysia

PriooCare has built a reputation for rapid adaptability and fostering partnerships with healthcare professionals. While excelling in health supplements and personal care, the company also dominates Malaysia’s growing cosmeceutical market. Its agile approach enables swift responses to shifting consumer demands.

2. Zuellig Pharma

A titan in Southeast Asia, Zuellig Pharma stands out with unparalleled nationwide coverage and temperature-controlled supply chains. Their expertise in public-private collaborations strengthens vaccine distribution and specialty medicine access, positioning them as critical infrastructure for Malaysia’s healthcare system.

3. DKSH Malaysia

Merging sales teams with full-spectrum logistics, DKSH bridges global pharmaceutical brands to local markets. Beyond distribution, they enhance retail visibility through customized point-of-sale displays and strategic merchandising campaigns tailored for pharmacies nationwide.

4. Apex Pharma

This mid-sized specialist focuses primarily on ethical medicines and over-the-counter products. By concentrating on prescription drug logistics and niche supplements, Apex Pharma fills gaps in chronic disease management while maintaining strong ties with medical practitioners.

5. Mega Lifesciences

Operating as both manufacturer and distributor, Mega Lifesciences leverages vertical integration to optimize pricing and availability. Their consumer health division boasts extensive retail penetration, particularly in rural areas where accessibility remains a challenge.

All five companies maintain NPRA certification, ensuring strict adherence to safety protocols. Many now offer digital tools like inventory dashboards and AI-driven sales analytics, empowering pharmacies to forecast demand and streamline orders. While competition intensifies, these distributors collectively elevate Malaysia’s healthcare resilience through innovation and reach. Their role becomes increasingly vital as the nation addresses aging populations and rising chronic illnesses.

The pharmacy distribution sector in Malaysia is undergoing rapid transformation, driven by technological advancements and shifting market demands. Industry leaders are adopting innovative strategies to stay competitive while meeting evolving healthcare needs. Let’s explore four pivotal developments redefining the sector’s trajectory.

1. Embracing Digital Infrastructure

Forward-thinking distributors have moved beyond traditional methods, adopting cloud-based inventory management as standard practice. These systems enable real-time tracking and predictive analytics, dramatically improving forecasting precision. By automating replenishment workflows, businesses can align stock levels with retailer demand cycles more effectively, minimizing both shortages and overstock scenarios.

2. Prioritizing Temperature-Sensitive Logistics

Cold chain capabilities have shifted from niche requirement to operational necessity. As more temperature-sensitive medications enter the market—from life-saving biologics to specialized probiotics—maintaining cold chain integrity has become non-negotiable for distributors. Not only due to product efficacy requirements, but also evolving regulatory standards. Investments in refrigerated storage and monitored transport now form the backbone of modern pharmaceutical logistics.

3. Bridging Physical and Digital Channels

Today’s consumers expect unified purchasing experiences across platforms. Distributors are responding by forging partnerships with e-commerce giants and local online pharmacies. Advanced integrations allow for direct-to-patient drop-shipping models while maintaining brick-and-mortar support. This dual-channel approach ensures medication availability whether customers visit physical stores or order via mobile apps.

4. Strategic Warehouse Decentralization

To combat delivery bottlenecks, companies are establishing compact fulfillment centers in emerging urban hubs like Ipoh and Kuantan. This isn’t just about faster deliveries—it’s strategic positioning that allows distributors to better serve growing populations in emerging economic hubs while reducing last-mile logistics costs.

These trends collectively signal a sector-wide shift toward agility and intelligence-driven operations. By combining IoT-enabled tracking with decentralized networks, Malaysian distributors are achieving unprecedented responsiveness. The result? A supply chain that’s not just efficient, but adaptable to sudden demand fluctuations—whether caused by seasonal illness spikes or public health emergencies.

As the industry continues evolving, success will hinge on balancing technological adoption with human-centric service design. Those who master this equilibrium will lead Malaysia’s pharmaceutical distribution into its next chapter, where speed, precision, and accessibility define operational excellence.

Learn More : The Future of Pharmaceutical Distribution Services in Malaysia: Trends and Innovations | An Overview of Cold Chain Management in Malaysia’s Pharmaceutical Distribution Sector | Temperature-Controlled Packaging Guide

Navigating Malaysia’s pharmaceutical distribution landscape involves tackling systemic hurdles that drain efficiency and stall market expansion. Below, we break down four critical barriers impacting stakeholders – and how industry leaders are adapting strategies to overcome them.

1. Bureaucratic Hurdles in Product Approvals

Delays in securing NPRA (National Pharmaceutical Regulatory Agency) certifications remain a persistent bottleneck. Lengthy approval timelines for new product variants often result in inventory shortages, causing retailers to miss prime sales windows. These gaps not only frustrate consumers but also derail carefully planned marketing campaigns, leaving manufacturers scrambling to regain momentum.

2. Inconsistent Last-Mile Delivery Networks

Geographic disparities exacerbate supply chain headaches. Urban hubs like Klang Valley face traffic snarls that delay deliveries, while rural regions such as Sabah and Sarawak grapple with infrastructural limitations. For perishable goods like vaccines or temperature-sensitive medications, these delays risk product integrity and erode trust in suppliers. Even non-perishables suffer when stock arrives too late for seasonal demand spikes.

3. Scattered Retail Ownership Structures

Despite rapid growth in pharmacy chains, over 60% of Malaysia’s drugstores operate as independent businesses. This fragmentation forces distributors to manage countless small accounts, inflating operational costs through duplicated routes and complex inventory management. The lack of centralized purchasing power also makes it harder to implement standardized practices or bulk discounts.

4. Shifting Brand Loyalty Dynamics

With slim profit margins, many pharmacies prioritize stocking whichever brands move fastest off shelves – even if it means frequently switching suppliers. This transactional mindset creates instability for manufacturers trying to forecast demand and complicates distributors’ efforts to maintain balanced inventories.

Forward-thinking distributors are countering these obstacles by deepening partnerships across the value chain. Tactics include:

Tailored Incentive Programs that reward consistent order volumes or prompt payments

Enhanced In-Store Support, such as branded POS displays and staff training on product benefits

Data-Driven Category Management workshops to help retailers optimize shelf space and inventory turnover

By aligning goals with both manufacturers and pharmacies, agile distributors are transforming transactional relationships into strategic alliances – proving that shared success often hinges on bridging gaps, not just moving products.

Key Takeaway: While systemic challenges persist, the sector’s evolution toward collaborative models signals a path forward. Still, stakeholders must remain adaptable as consumer expectations and regulations continue to shift in this dynamic market.

Learn More : Cost-Effective Strategies for Pharmacy Distribution in Malaysia | NPRA in Malaysia Has Broadened Reference Approval Guidelines

Strategic partnerships between pharmacies and distributors thrive when they extend beyond mere product transportation. Let’s explore three real-world scenarios where innovative support structures drove measurable success for health brands.

Case Study 1: Launching a Skincare Line with Tailored Retail Activation

When an emerging skincare brand partnered with a specialty pharmaceutical distributor, the alliance focused on immersive in-store engagement. Beyond basic logistics, the distributor deployed eye-catching point-of-sale materials (POSM), supplied pharmacists with interactive demo kits, and orchestrated localized promotional campaigns. The result? Retail presence skyrocketed from 15 initial outlets to 120+ stores within six months—proving that visual merchandising and hyper-targeted outreach can amplify shelf impact.

Case Study 2: Synchronized Nationwide Rollout for Supplements

Scaling a product launch across major chains demands precision. DKSH’s collaboration with a leading supplement brand exemplifies this. By integrating temperature-controlled logistics for sensitive formulations, synchronizing eCommerce stock levels with brick-and-mortar launches, and generating store-specific sales analytics, the campaign achieved seamless nationwide distribution through Guardian, Watsons, and Caring outlets. This holistic approach ensured consistent product availability while enabling data-driven inventory adjustments.

Case Study 3: Equipping Pharmacies for Regulated Herbal Products

For compliance-sensitive items like herbal supplements, knowledge gaps can hinder sales. PriorooCare addressed this proactively before introducing a new line. They conducted NPRA-approved documentation workshops and hands-on product training sessions for pharmacy staff. This not only streamlined regulatory adherence but pharmacists emerged as confident advocates, leading to a 35% increase in cross-selling rates post-launch.

These models underscore a critical insight: modern distributor partnerships excel when they blend operational expertise with value-added services. Whether through localized marketing, integrated tech solutions, or frontline education, the brands that prioritize collaborative innovation consistently outperform competitors. By treating distributors as strategic allies rather than shipping vendors, companies unlock scalability, compliance, and consumer trust in crowded healthcare markets.

Key Takeaway: Success hinges on choosing partners who invest in your brand’s unique needs—not just moving boxes.

Learn More : Top 10 Visual Merchandising Tips

As Malaysia’s health and wellness sector evolves, brands and pharmacies must strategically align their distribution strategies to capitalize on shifting consumer demands. Let’s explore four critical areas poised to define success this year.

1. Trending Wellness Niches

Rising health consciousness is reshaping purchasing habits, with distributors noting surging interest in three key categories: gut health supplements (like probiotics), female wellness products, and halal-certified personal care items. These segments cater to culturally nuanced preferences while tapping into broader global wellness trends, making them high-potential growth drivers for retailers and suppliers alike.

2. Boutique Pharmacy Partnerships

Smaller, independent pharmacies are gaining traction as valuable allies. Beyond offering improved profit margins compared to larger chains, these outlets foster personalized customer relationships—a goldmine for brands testing new products. Partnering with agile distributors familiar with boutique networks can streamline localized launches and gather real-time consumer insights.

3. Data-Driven Retail Collaboration

Success isn’t just about stocking shelves; it’s about optimizing visibility. Forward-thinking distributors now provide end-to-end support, from strategic shelf placement to staff training programs that incentivize product advocacy. Timing promotional campaigns to align with cultural events or seasonal demand further amplifies impact, giving brands a competitive edge in crowded aisles.

4. Streamlining International Market Entry

For overseas brands, navigating Malaysia’s regulatory landscape—including NPRA certification—remains a hurdle. Local distributors with expertise in compliance, logistics, and consumer behavior bridge this gap. They not only simplify approvals but also assist with storage solutions and culturally attuned marketing strategies, turning market entry challenges into opportunities.

Malaysia’s pharmacy sector rewards innovation, but scalability depends on selecting distribution partners who blend market intelligence with operational flexibility. Whether launching niche products or expanding cross-border, aligning with collaborators that understand regional dynamics will separate industry leaders from the rest. After all, in a market this dynamic, adaptability isn’t optional—it’s essential.

For healthcare brands and pharmacies operating in Malaysia’s dynamic market, strategic partner selection can determine market penetration and long-term viability. With evolving consumer demands and regulatory complexities, aligning with distributors that offer multifaceted value requires careful analysis. Let’s explore critical considerations to optimize these collaborations.

Beyond basic logistical capabilities, evaluate potential collaborators through these operational lenses:

Regulatory Compliance Expertise

Confirm partners hold active NPRA certifications and demonstrate up-to-date licensing practices—this ensures product legitimacy and minimizes regulatory risks.

Geographic Reach & Specialized Logistics

Prioritize distributors with temperature-controlled warehousing and documented success servicing both Peninsular and East Malaysia. Their delivery network should adapt to urban hubs and rural communities alike.

Relationship-Driven Account Management

Seek teams offering dedicated support through inventory alerts, demand forecasting, and rapid issue resolution—not just transactional interactions.

In-Store Activation Capabilities

Assess their ability to execute eye-catching POS displays, promotional campaigns, and staff training programs that amplify product visibility.

Future-Proof Scalability

Can their infrastructure and tech systems accommodate sudden order surges or regional expansions without service degradation?

“How granular is your inventory visibility across distribution channels?”

“What percentage of pharmacies in our target regions do you actively supply?”

“Describe a scenario where you helped brands overcome supply chain bottlenecks.”

Trusted pharmacy distributors in Malaysia act as growth accelerators—not mere middlemen. Partners with robust cold chain protocols, regulatory savvy, and strong retail networks enable brands to bypass operational hurdles while securing prime shelf space. By prioritizing collaborators invested in mutual success, businesses transform routine distribution into a competitive advantage that drives prescription fulfillment rates and customer retention.

The right alliance elevates brands from simply moving products to building lasting market presence—imperfect logistics or misaligned priorities can derail even the most promising healthcare innovations. Choose wisely.

Malaysia’s pharmaceutical and wellness sector is undergoing a transformative shift toward greater professionalism. Heightened regulatory oversight, an influx of new product lines, and intensifying competition in retail pharmacy operations are reshaping industry dynamics. In this climate, distributor partnerships have evolved from transactional relationships to strategic growth enablers—demanding deeper alignment with business objectives.

Local independent distributors often excel in responsiveness and niche market understanding, offering tailored support for emerging brands. Meanwhile, established national wholesalers provide broad geographic coverage and supply chain resilience. The decision now hinges not merely on pricing but on synergies—can your partner adapt to regulatory shifts, amplify brand visibility, and align with your roadmap for market penetration?

Struggling to balance regulatory rigor with aggressive sales targets? PriooCare Malaysia redefines distributor partnerships by merging operational excellence with growth-centric strategies. From groundbreaking nutraceuticals to trending skincare innovations, we specialize in turning regulatory compliance into competitive advantages.

→ Category-Specific Distribution Networks: Leverage channel expertise optimized for your product type, from OTC medications to premium wellness supplements.

→ Shelf Dominance Strategies: Data-driven POSM campaigns and retail merchandising support to secure prime placements.

→ End-to-End Regulatory Navigation: Simplify NPRA approvals, documentation, and post-market compliance with dedicated specialists.

At PriooCare, we don’t just deliver products—we architect market entry and expansion strategies. Our team combines regulatory expertise with commercial savvy, ensuring your products not only meets compliance benchmarks but also captures consumer attention in crowded retail environments.

Ready to transform distribution challenges into scalable opportunities? Connect with PriooCare’s Pharma Solutions Team. Explore partnership models designed for Malaysia’s dynamic wellness landscape. From initial submissions to nationwide rollouts, we’re here to elevate your brand’s trajectory.