June 8, 2025

In Malaysia’s competitive health and wellness sector, securing KKM (Kementerian Kesihatan Malaysia) approval isn’t merely a box-ticking exercise—it’s the critical regulatory checkpoint that unlocks commercial opportunities. Whether you’re launching pharmaceuticals, skincare innovations, or nutraceuticals, authorization from the Ministry of Health (handled by NPRA for medicines or MDA for medical devices) serves as the golden ticket for legal market entry. Retail partnerships with pharmacy distributors—from boutique pharmacy partners to major wholesale operators—hinge entirely on this certification. Without valid kelulusan KKM, even the most promising product faces an insurmountable barrier before reaching consumers.

This guide highlights recurring pitfalls that derail approval applications, offering actionable insights for brands aiming to streamline compliance. While businesses often focus on formulation or branding, missteps in regulatory processes remain a silent growth killer. Common errors range from incorrect product categorization—a frequent issue for hybrid items like cosmeceuticals—to incomplete technical dossiers that lack stability data or safety assessments. Surprisingly, these oversights aren’t limited to startups; even established brands occasionally stumble by treating KKM submissions as an afterthought rather than a strategic priority.

One often-overlooked hurdle involves misunderstanding regional distributor requirements. Pharmacy wholesale distributors Malaysia-wide often impose additional quality benchmarks beyond baseline KKM standards. Aligning your application with both regulatory and partner expectations prevents costly delays. Another critical misstep? Relying on generic templates for labeling or claims, which rarely meet Malaysia’s evolving compliance framework.

By addressing these challenges proactively, companies can transform approval timelines from months-long bottlenecks into competitive advantages. The difference lies in meticulous preparation: accurate documentation, precise product classification, and collaboration with experts familiar with NPRA/MDA workflows. Avoid these pitfalls, and your path to pharmacy shelves—and consumer trust—becomes infinitely smoother.

Next in this series: How to prepare watertight documentation for KKM submissions—plus insider tips for resolving common rejections.

Learn More : Ultimate Guide to KKM Approval in Malaysia

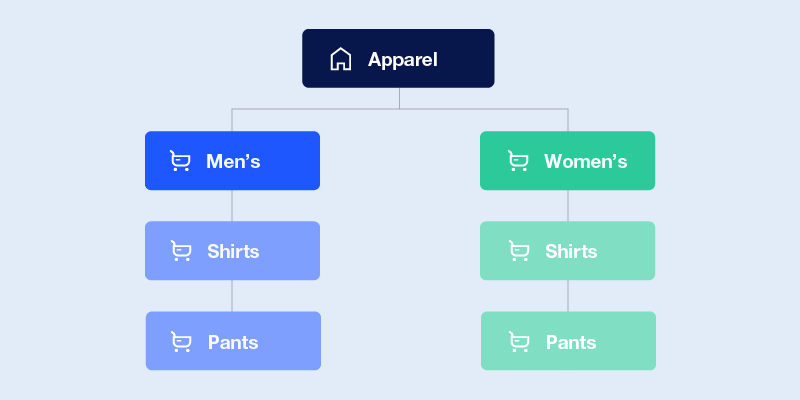

Navigating Malaysia’s regulatory landscape can feel like a maze for businesses launching health-related products. A frequent oversight? Misunderstanding whether your item falls under MAL registration (for pharmaceuticals and supplements), NOT notification (cosmetics), or MDA licensing (medical devices). Each pathway carries distinct guidelines managed by separate agencies, and errors in classification risk more than delays—they can strain partnerships, invite audits, and tarnish your brand’s credibility.

Take skincare startups, for example. Imagine marketing a brightening serum as a dietary supplement under MAL, only for regulators to flag it months later as a non-compliant kosmetik lulus KKM (approved cosmetic) requiring NOT submission. Such missteps force companies to backtrack, wasting time and resources. Distributors and pharmacy chains, reliant on timely approvals to stock shelves, face disrupted timelines that ripple through supply chains. Over time, repeated issues erode confidence in your ability to meet compliance standards—a critical asset when collaborating with Malaysia’s tightly regulated healthcare networks.

The stakes escalate when medical devices enter the picture. A wearable glucose monitor mistakenly filed under MAL instead of MDA licensing, for instance, could languish in regulatory limbo. Authorities may question whether safety assessments align with device-specific protocols, sparking inquiries or fines. Even minor oversights, like incomplete documentation for a herbal supplement, risk rejection letters that push launch dates by quarters.

Why does this happen? Regulatory frameworks evolve, and nuances between categories blur. A “beauty drink” with bioactive ingredients might straddle cosmetic and supplement definitions, demanding careful analysis. Without expertise, teams default to assumptions—like treating all topicals as cosmetics—ignoring formulations that cross into therapeutic claims.

Pro tip: Invest early in regulatory consultations or third-party audits. Clarify ambiguities with agencies like the Medical Device Authority (MDA) or the National Pharmaceutical Regulatory Agency (NPRA). Double-check whether your product’s function, marketing claims, and ingredients align with category definitions.

Remember: Precision in classification isn’t just paperwork—it’s the bedrock of market entry. A misstep here doesn’t just delay your launch; it signals unreliability to partners and customers alike. Stay proactive, stay informed, and ensure your product’s journey to shelves is smooth, compliant, and trustworthy.

Learn More : Overview of the registration process for natural products in Malaysia

Malaysia’s KKM (Ministry of Health) maintains rigorous standards for product registrations—and for good reason. Submitting incomplete paperwork immediately raises concerns with regulators, jeopardizing your chances of market entry. Whether you’re applying for cosmetics, supplements, or medical devices, every component of your submission matters. Omissions like a Certificate of Analysis (CoA), incomplete Product Information Files, or non-compliant labeling in Bahasa Malaysia can trigger instant rejections. Overlooking fundamental requirements—say, stability testing data or mandatory Halal certifications—doesn’t just delay approvals; it risks your product’s entire commercial viability.

Consider this: A single missing document can derail timelines by months. Take the case of a Selangor-based skincare supplement producer that overlooked safety test validations. The oversight forced a six-month delay in their KKM approval process, stalling partnerships with pharmacy distributors and costing them prime shelf placements during peak sales seasons. With competitors capitalizing on the gap, the brand lost both revenue and consumer trust—a stark reminder that regulatory compliance isn’t just about checkboxes.

Why does this happen? Regulators prioritize consumer safety, meaning incomplete submissions signal potential risks. For instance, absent stability tests raise questions about product shelf life, while missing Halal credentials limit accessibility in Malaysia’s majority-Muslim market. Even minor formatting errors in Bahasa Malaysia labels—like font size discrepancies or incomplete ingredient lists—can prompt rejections. These aren’t hypotheticals; they’re daily hurdles for unprepared brands.

The solution lies in proactive preparation. Start by auditing your documentation against KKM’s latest guidelines, cross-referencing every requirement from technical dossiers to translated packaging drafts. Partner with local regulatory experts to identify gaps—they’ll spot nuances outsiders might miss, like updates to safety assessment protocols. Also, allocate buffer time for unexpected revisions; last-minute fixes to labeling or test reports are common.

Ultimately, thorough documentation isn’t just a bureaucratic step—it’s your first line of defense against costly delays. By treating compliance as a strategic priority, you safeguard launch timelines, distributor relationships, and your brand’s reputation. After all, in Malaysia’s competitive retail landscape, speed to market hinges on getting it right the first time.

Pro tip: Double-check if your manufacturer or third-party labs have updated their certifications—expired accreditations quietly trip up even seasoned companies.

Learn More : Medicinal Products Registration in Malaysia, NPRA Registration

Considering managing product registration independently? While the DIY approach might appear budget-friendly initially, hidden expenses from potential rejections, appeals, or product reclassifications often prove more costly over time. Constantly evolving NPRA documentation requirements, intricate regulatory terminology, and frequent updates to cara semak produk lulus KKM create a landscape where only experienced professionals can effectively guide applicants through compliance challenges. What begins as a seemingly straightforward process can quickly spiral into bureaucratic delays, particularly for those unfamiliar with Malaysia’s dynamic regulatory environment.

Collaborating with a pharmacy distribution partner that offers localized regulatory expertise delivers advantages far beyond simple supply chain management. One recent case study illustrates this clearly: A startup utilizing specialized advisory services secured their Notification of Token (NOT) approval five times quicker than competitors attempting self-filing. For emerging businesses, this decision translates to a straightforward ROI calculation – would you rather invest RM10,000 in expert guidance today or risk forfeiting RM100,000 through postponed market entry tomorrow? The ever-changing nature of compliance standards means that what worked yesterday may not suffice tomorrow, making continuous expert oversight invaluable.

Startups and established brands alike face a critical choice when launching products. While self-managed applications might seem appealing, the risks of procedural errors or missed deadlines often outweigh short-term savings. Regulatory partners don’t just streamline paperwork; they provide strategic insights into NPRA expectations and preempt common pitfalls. In an environment where regulatory missteps can derail product launches, strategic partnerships transform bureaucratic hurdles into competitive advantages. After all, isn’t securing timely market access worth more than cutting corners?

Learn More : How to Ensure Regulatory Compliance for Pharmacy Distribution in Malaysia

When expanding into Malaysia’s pharmacy market, brands frequently overlook a critical factor: their distributor’s ability to manage regulatory demands. A distributor’s expertise in local compliance isn’t just a checkbox—it’s the backbone of successful product commercialization. If your chosen partner lacks dedicated teams to confirm Malaysian Ministry of Health (KKM) compliance status, share actionable market insights, or conduct thorough evaluations to prepare products for listings, even approved items risk stagnation. Without these capabilities, delays in shelf placement and revenue loss becomes inevitable.

Many startups fall into the trap of prioritizing cost over capability, partnering with distributors that offer lower fees but lack direct pharmacy networks. This shortsighted approach often backfires once regulatory approval is secured. Suddenly, brands face the costly scramble to find a new partner—one with established pharmacy relationships and familiarity with Malaysia’s evolving compliance landscape. These transitions disrupt timelines, strain budgets, and erode competitive advantage.

To avoid these pitfalls, prioritize distributors who align with proven standards for Malaysia pharmacy distribution services. Look for partners with a documented history in guiding brands from regulatory clearance to retail success. Key indicators include proactive KKM engagement, transparent communication with pharmacies, and tailored support for listing requirements. Such collaborators don’t just simplify compliance—they accelerate market entry by bridging regulatory and commercial gaps.

Ultimately, the right distributor acts as an extension of your team, ensuring seamless transitions from paperwork to product visibility. By investing in a partner versed in both regulatory nuance and retail execution, brands position themselves to capitalize on Malaysia’s growing pharmaceutical opportunities without unnecessary roadblocks. Don’t let a lack of preparation undermine your market potential—choose wisely, and prioritize long-term agility over short-term savings.

Learn More : Cost-Effective Strategies for Pharmacy Distribution in Malaysia

Regulatory authorities frequently flag items due to labeling discrepancies, which remain a leading cause of approval bottlenecks. Common oversights include absent Bahasa Malaysia translations, unauthorized therapeutic assertions like claiming to “cure eczema,” and omitting mandatory KKM registration codes. Such errors don’t just slow authorization processes—they can derail partnerships with pharmacy distributors before products even hit shelves.

Malaysia’s National Pharmaceutical Regulatory Agency (NPRA) maintains stringent guidelines governing everything from typography to ingredient transparency. Cosmetic and supplement manufacturers must adhere to specific criteria, including minimum font sizes for warnings, clear allergen declarations, and scientifically backed marketing claims. In 2023 alone, over 700 products faced rejection due labeling inaccuracies—a stark reminder of the financial and operational risks involved. These compliance failures create domino effects, disrupting wholesale distribution agreements, complicating digital catalog integrations, and delaying e-commerce launches.

The stakes extend beyond regulatory penalties. Pharmacy chains often reject non-compliant items outright, while online platforms remove listings that lack proper certifications. Even minor oversights, like inconsistent ingredient formatting or misplaced disclaimer text, can trigger months of revisions. For businesses eyeing the Malaysian market, meticulous label reviews aren’t optional—they’re critical to maintaining supply chain momentum.

Pro Tip: Integrate NPRA’s requirements early in your design process. Collaborate with local regulatory experts to audit content for prohibited claims and technical specifications. Automated tools can help flag formatting issues, but human oversight remains essential for contextual accuracy.

By prioritizing label compliance, brands not only avoid costly delays but also strengthen credibility with distributors and consumers. After all, in regulated markets, attention to detail isn’t just about legality—it’s a competitive advantage.

Learn More : Registering a Cosmetic Product in Malaysia

Ever wondered how Malaysian regulators categorize your health product? The line between supplements, functional foods, and quasi-drugs isn’t always clear—and missteps can derail your market entry. Under KKM’s framework, classifications hinge on three pillars: ingredient profiles, intended use, and marketing claims. Overlook these details, and your product could face costly reclassification, delays, or even reputational damage.

Consider this real-world scenario: A company launched a vitamin-enriched drink initially registered as a general food product. Months later, regulators reclassified it as a functional food due to its bioactive ingredients and implied health benefits. This triggered a mandatory MAL (Medicines Advertisement Board) approval process—a hurdle the brand hadn’t anticipated. The fallout? Forced removal from major retail platforms and pharmacy distributors backing out over compliance concerns. Rebuilding those partnerships took months, not to mention lost revenue.

The lesson here? Never assume your product’s category aligns with regional standards. KKM’s guidelines—accessible through the NPRA’s classification database—require meticulous review. But paperwork alone isn’t enough. Collaborate early with local pharmacy distributors familiar with Malaysia’s regulatory nuances. These partners often spot red flags, like mismatched claims or ingredient thresholds, before submissions hit NPRA’s desk.

Pro tip: Functional foods and cosmetics-turned-quasi-drugs face stricter scrutiny. Words like “reduces inflammation” or “treats dryness” could shift your product into a regulated drug category overnight. When in doubt, conduct a pre-submission audit with experts to stress-test your labeling and claims.

Avoid becoming a cautionary tale. Invest time in classification research, lean on local expertise, and always cross-reference NPRA updates. After all, in regulatory compliance, foresight isn’t just best practice—it’s business insurance.

Navigating regulatory approvals while maintaining commercial momentum remains a critical challenge for brands entering the Malaysian market. Many companies rush to secure KKM (Kementerian Kesihatan Malaysia) certification prematurely, only to face unexpected hurdles in securing pharmacy distribution partnerships. Why? Without confirming retailer demand or addressing competitive gaps, even approved products often struggle to gain traction on shelves.

The root issue lies in timing misalignment. Eager brands frequently treat regulatory clearance as the starting line rather than integrating it with strategic market entry plans. Imagine securing KKM approval only to discover pharmacies aren’t interested in your product’s formulation, pricing, or packaging. This disconnect creates costly delays and wasted resources—problems easily avoided through coordinated planning.

Here’s the smarter approach: Synchronize your KKM submission timeline with actionable go-to-market strategies. Local pharmacy distributors possess invaluable insights into retailer preferences, allowing brands to refine SKU configurations, adjust pricing models, and align with seasonal listing cycles before finalizing regulatory paperwork. One collagen beverage startup we advised exemplifies this strategy. Instead of rushing their KKM application, they invested three months in pilot launches and distributor feedback sessions. The result? Four major pharmacy chains committed to stocking their product immediately post-approval—avoiding the common “approval limbo” phase entirely.

Three key lessons emerge:

Validate First, Certify Later – Use distributor networks to pressure-test product-market fit.

Adaptability Wins – Adjust formats or bundle offerings based on early retailer input.

Timing Is Revenue – Align approval dates with distributors’ inventory refresh periods.

By treating KKM compliance as one component of a broader commercial roadmap—not an isolated milestone—brands transform regulatory steps into strategic advantages. The collagen drink case proves that patience paired with proactive planning drives faster shelf placement and sustainable growth. After all, what good is approval if your product collects dust in warehouses?

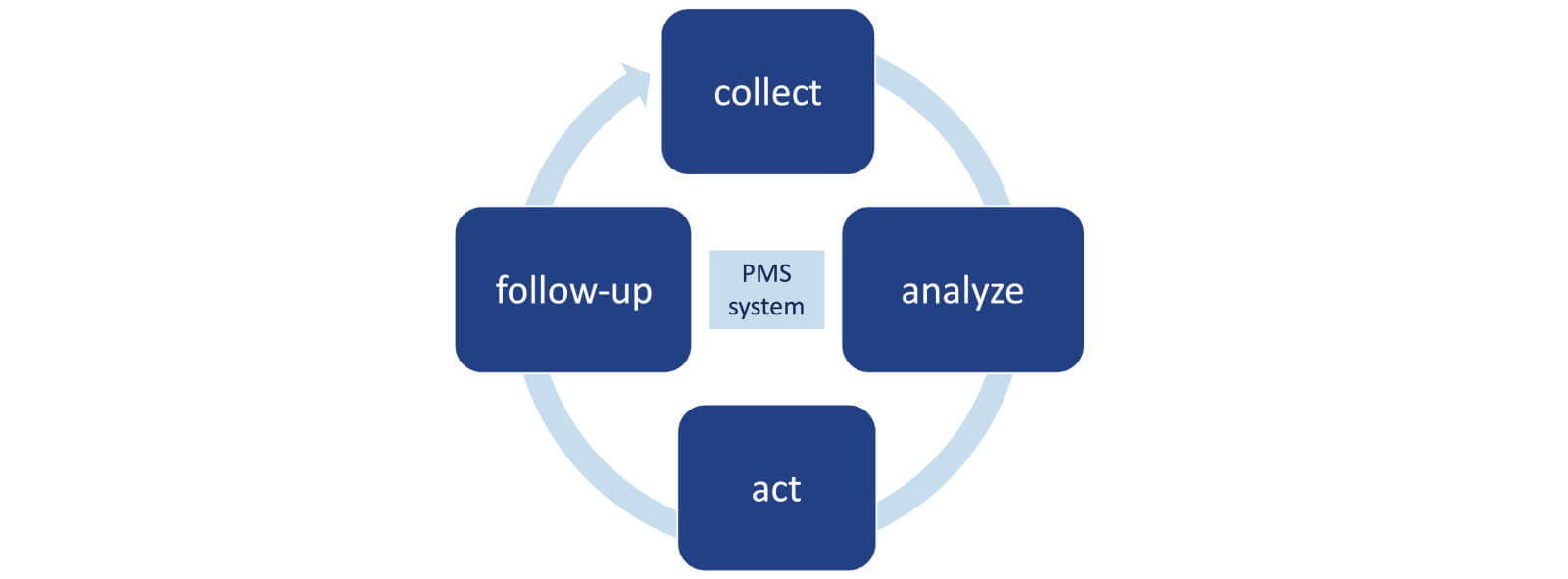

A common misconception among businesses is that regulatory compliance concludes once a product secures KKM approval. In reality, the process shifts to an equally critical phase: ongoing adherence to Malaysia’s medical product regulations. Organizations must prioritize three pillars—post-market monitoring, mandatory incident reporting, and proactive license renewals—to maintain compliance. Neglecting these obligations risks severe repercussions, including product deregistration, suspension of sales permits, or financial penalties. This is particularly crucial for pharmacy distributors in Malaysia that depend on automated compliance systems, as gaps in oversight can trigger regulatory audits.

Recent enforcement trends underscore these risks. A 2023 NPRA compliance review revealed that approximately one-fifth of non-compliant products traced back to smaller companies with inconsistent renewal practices. Such lapses don’t just strain regulatory relationships—they directly influence purchasing decisions among pharmacy wholesale distributors, who prioritize partners with flawless compliance records.

To mitigate these challenges, businesses should implement two strategic safeguards. First, develop internal protocols for periodic KKM documentation reviews, paired with centralized renewal tracking systems. Second, align these processes with your pharmacy distributors’ operational workflows through shared digital platforms or API integrations. This synchronization ensures real-time updates on regulatory changes and audit requirements, reducing manual errors.

While automation tools streamline compliance management, human oversight remains irreplaceable. Assign dedicated teams to review adverse event reports within 72 hours of notification and conduct quarterly mock audits. These proactive measures not only prevent regulatory missteps but also strengthen your standing as a reliable supplier in Malaysia’s competitive pharmaceutical landscape.

By treating KKM compliance as a continuous cycle—not a one-time milestone—companies safeguard their market position while building trust with distributors and regulators alike. Remember, in regulated industries, sustained success hinges not just on initial approvals, but on consistent, transparent post-market practices.

Learn More : Malaysia NPRA: Guidance on Drug Registration

Securing KKM approval isn’t just another bureaucratic hurdle—it’s the foundation for building consumer confidence, streamlining market entry, and establishing competitive advantage. While many businesses fixate on document submissions, true success lies in avoiding critical oversights like product category mismatches or unreliable distribution chains. These missteps don’t just delay timelines—they erode profit margins and brand credibility in Malaysia’s tightly regulated health product sector.

Whether introducing anti-aging serums, nutraceuticals, or diagnostic equipment, your regulatory strategy can’t operate in a silo. Proactive collaboration with certified compliance specialists and vetted pharmacy networks transforms approval from a checklist exercise into a growth accelerator. By integrating KKM requirements into R&D phases and supply chain planning, companies sidestep the 6-12 month setbacks that derail unprepared competitors.

The hidden cost of treating compliance as an afterthought? Missed shelf placements, rushed formula revisions, and fractured distributor relationships. Consider this: 34% of delayed launches trace back to incorrect product classifications discovered during final review stages.

Smart brands leverage KKM preparation to strengthen their entire market position. It’s about building distributor trust through audit-ready documentation while simultaneously mapping retail partnerships that align with your target demographics. This dual focus separates market leaders from brands stuck in perpetual “pending approval” status.

With Malaysia’s pharmacy sector projected to grow 8.4% annually through 2027, strategic distribution is non-negotiable. PriooCare’s nationwide network—serving 2,600+ pharmacies—provides more than regulatory navigation. Our end-to-end support identifies ideal retail partners, optimizes launch timing with compliance milestones, and provides real-time market feedback to sharpen your competitive positioning.