August 7, 2025

In Malaysia’s dynamic healthcare environment, getting your product onto pharmacy shelves isn’t just about quality – the path it takes is absolutely crucial. Seriously, the distribution model you pick dictates how smoothly medicines, essential supplements, and everyday wellness items actually reach the people who need them. This is especially true now, with regulations tightening and competition fiercer than ever. Choosing between a local, independent pharmacy distributor and a big international pharmacy wholesale player? That single decision ripples out, impacting far more than just geographic reach; it fundamentally influences your regulatory standing, your bottom-line costs, and perhaps most importantly, the hard-earned trust of pharmacists and patients alike.

So, what’s the real difference on the ground? An independent pharmacy distributor is typically deeply rooted right here in Malaysia. Their strength lies in those hyper-local relationships – they know the pharmacists, understand the regional quirks, and can pivot quickly when the market shifts. It’s agility fueled by proximity. On the flip side, a distributor pharmacy working through international wholesalers taps into vast global networks. Think massive multinational supply chains offering potentially wider sourcing and different logistical muscle. This isn’t just some theoretical business school exercise; understanding these distinct models is downright vital for any brand aiming to carve out a real presence and win in Malaysia’s complex pharmacy retail sector. The stakes are simply too high to get this wrong.

This article dives deep, unpacking the genuine pros and cons of each distribution path. We’ll cut through the noise to give pharmaceutical companies and consumer healthcare brands the clear, actionable insights needed to make truly informed choices. Because in Malaysia’s healthcare landscape, your distributor isn’t just a logistics provider – they’re a strategic partner shaping your market success. Getting this partnership right unlocks efficiency, ensures compliance, builds trust, and ultimately, gets vital products reliably into the hands that need them.

Navigating Malaysia’s healthcare sector demands a robust and reliable pharmaceutical supply chain. But what does a genuinely effective pharmacy distribution service actually look like within this tightly regulated environment? It’s more than just moving boxes; it’s the vital circulatory system ensuring medicines reach every corner safely, reliably, and within the strict legal framework.

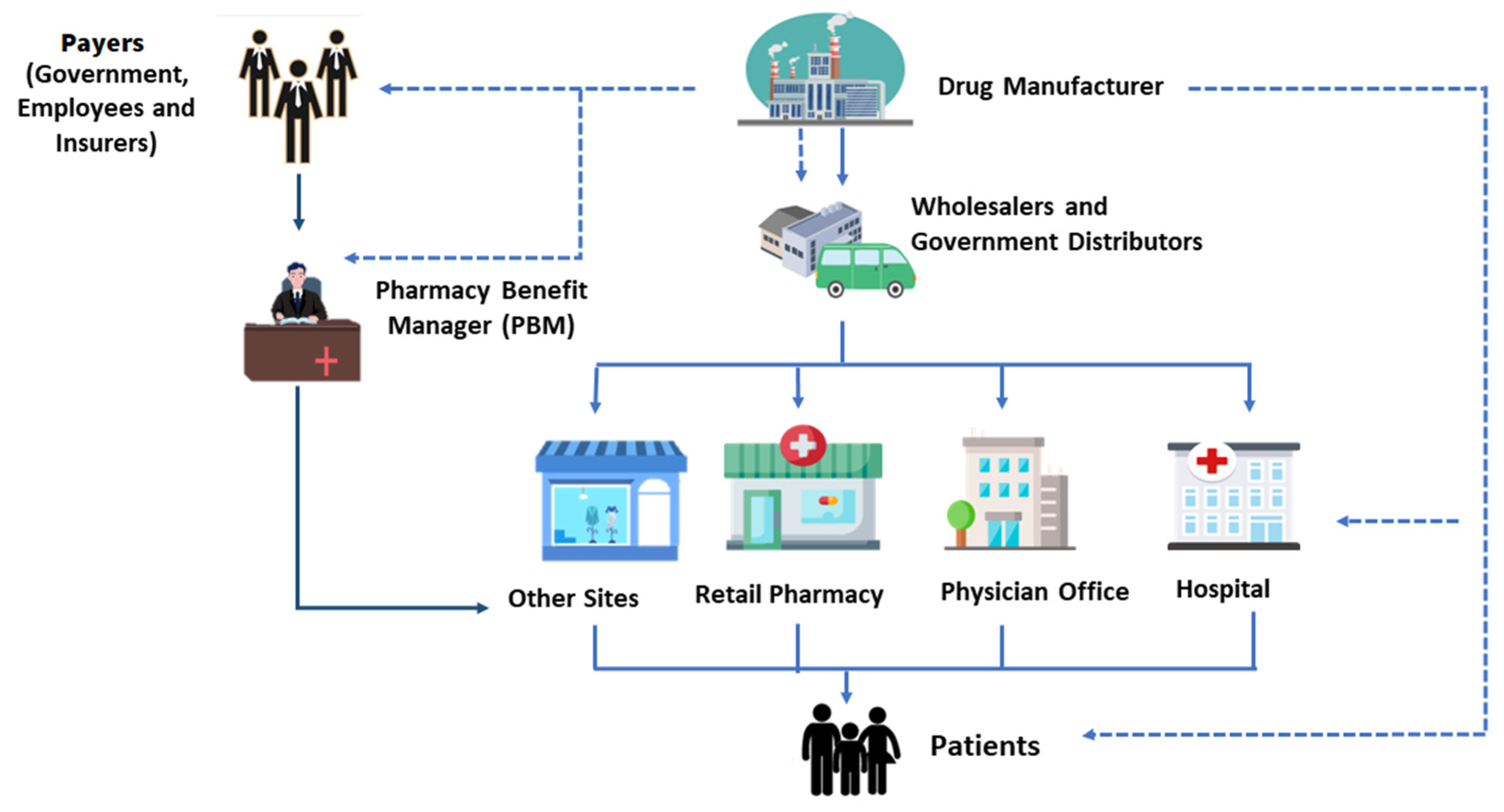

Malaysia operates a complex, multi-layered supply chain involving numerous players – from the initial manufacturers and importers, through crucial wholesale distributors, and finally down to the retail pharmacy networks serving the public. This entire system functions under rigorous oversight. The National Pharmaceutical Regulatory Agency (NPRA), part of the Ministry of Health (MOH), acts as the primary guardian, enforcing rules designed to guarantee drug safety, quality, and accessibility for all Malaysians.

Compliance isn’t optional; it’s foundational. Every single product entering the market must secure the correct regulatory approvals. This means navigating pathways like obtaining MAL numbers for pharmaceuticals or NOT numbers for cosmetics, depending precisely on the product category. Distributors themselves operate under the mandatory umbrella of Good Distribution Practice (GDP) standards. These aren’t just suggestions; they are essential protocols safeguarding product integrity throughout the entire journey – from warehouse storage conditions right through to final delivery. Think temperature control, humidity monitoring, and meticulous handling procedures.

Beyond mere compliance, operational excellence defines effectiveness. A top-tier distributor consistently delivers on several critical fronts:

Reach and Reliability: Ensuring timely deliveries isn’t just about major cities; it means overcoming logistical hurdles to reliably service pharmacies in both bustling urban centres and harder-to-reach rural locations. Speed and consistency matter immensely.

Visibility and Control: Robust inventory tracking systems are non-negotiable. Pharmacies and suppliers need real-time visibility into stock levels and product movement. Furthermore, maintaining the cold chain for temperature-sensitive products (like vaccines or biologics) is absolutely paramount – deviations can render vital medicines useless.

Regulatory Partnership: Truly effective distributors act as partners in compliance. They proactively support adherence to all KKM (MOH) regulations and have clear, efficient processes in place for critical situations, such as managing product recalls swiftly and effectively, minimizing risk.

Ultimately, the distributor you select isn’t just a vendor; they’re a strategic extension of your operations. Their capabilities directly shape your pharmacy’s ability to maintain consistent stock, serve patients without interruption, meet stringent regulatory demands, and stay competitive within Malaysia’s dynamic healthcare market. Choosing wisely is fundamental to sustainable success. Getting this partnership right makes all the difference.

Learn More : WHO Good Storage and Distribution Practices for Medical Products

Breaking into Malaysia’s complex pharmaceutical sector demands smart strategy. Could partnering with an independent, local distributor be the key advantage your brand needs? Often overlooked, these regional players offer unique strengths that larger entities might struggle to match.

Their primary edge? Operational agility. Built on leaner structures, local distributors foster incredibly close ties with pharmacists, merchandisers, and store managers across their territories. This deep network isn’t just about rapport; it translates directly into lightning-fast responsiveness. When sudden stockouts threaten sales, promotional windows open, or unexpected regulatory tweaks hit, these partners can pivot and act immediately to keep your products moving. They’re simply closer to the daily realities of the retail pharmacy floor.

Beyond speed, local distributors bring invaluable cultural and regional insight, particularly crucial for navigating the distinct logistics and business landscapes of East Malaysia versus the peninsula. They inherently understand local preferences, operational nuances, and potential roadblocks that outsiders might miss. This granular understanding complements their direct relationships with both major chain outlets and independent pharmacies. For instance, a distributor focused on Selangor excels at servicing its network through consistent, face-to-face visits, personalized detailing sessions, and crafting merchandising strategies tailored to each outlet’s specific customer base and layout.

Furthermore, these partners frequently provide critical on-the-ground support that extends far beyond simple delivery. This can include hands-on assistance with product trials directly in pharmacies, comprehensive training programs for pharmacy staff on new product ranges and benefits, and offering more flexible credit and delivery terms – a lifeline especially for newer or smaller brands establishing themselves.

While it’s true that their absolute scalability across the entire nation might be limited compared to massive conglomerates, this potential constraint is counterbalanced by exceptional customer intimacy and agility. For smaller pharmaceutical companies or those with specialized, niche products, the unmatched value lies precisely in this focus. A dedicated local partner gets what’s needed where it counts, building trust and presence at the pharmacy level in a way larger players often can’t replicate. In the nuanced Malaysian market, that local touch can absolutely provide the competitive edge you’re seeking. They ensure your product isn’t just on the shelf, but understood and promoted effectively right where the customer is.

For established pharmaceutical brands eyeing significant market growth across regions like ASEAN, collaborating with a major international distribution partner is often a pivotal consideration. Giants in the space – think Zuellig Pharma, DKSH, or IQVIA (formerly IMS Health) – bring undeniable strengths to the table, primarily rooted in their massive operational scale and sophisticated infrastructure. But is this powerhouse approach the right fit for your brand’s ambitions? Let’s unpack the value proposition and the ideal scenarios.

The core appeal lies in leveraging the distributor’s immense resources. Economies of scale become a tangible benefit: by consolidating warehousing, procurement efforts, and shipping logistics across vast networks, these players achieve lower per-unit costs that can significantly improve your product’s margin potential or competitiveness. Beyond just moving boxes, they invest heavily in advanced digital technology systems. This translates to crucial capabilities like real-time inventory visibility across the entire supply chain, comprehensive reporting dashboards for performance tracking, and often, integrated e-detailing tools to support your field force digitally. Furthermore, their unparalleled network reach is hard to replicate. They possess the established relationships and logistical muscle to efficiently service sprawling national pharmacy chains (such as Guardian or Watsons) and navigate the complex procurement pathways of hospital pharmacies simultaneously.

However, that scale comes with inherent structural characteristics. Multinational distributors typically operate on highly standardized, often rigid systems and processes. While efficient for high-volume flows, this can mean the onboarding process for new brands is complex and time-consuming. A critical point for smaller or newer entrants: unless your projected volumes are substantial from the outset, your brand might receive lower prioritization within their vast portfolio. Securing dedicated attention and agile support can be an uphill battle without guaranteed scale.

Despite these potential friction points, partnering with an international distributor becomes a highly strategic move in several specific situations:

Launching Complex Therapies: Introducing a temperature-sensitive prescription drug requiring extensive, validated cold-chain logistics? Their established infrastructure and expertise are invaluable, often non-negotiable for compliance and product integrity.

Executing Rapid Nationwide Expansion: If your strategy demands simultaneous product availability across an entire country or region quickly, their pre-existing network is the fastest, most reliable route to market saturation.

Targeting Diverse Sales Channels: When market entry requires penetration into both major retail pharmacy chains and institutional hospital procurement systems, a global partner provides the single-point access needed to efficiently tackle both fronts.

Ultimately, choosing a global distribution powerhouse is about prioritizing consistency, extensive reach, and cost efficiencies derived from scale. It’s the preferred path for established brands needing widespread, reliable coverage, especially for complex or rapid rollouts. Just be prepared: this choice often means sacrificing some degree of the local market agility and high-touch responsiveness that smaller, regional distributors might offer. Weigh your brand’s specific needs, volume potential, and tolerance for process carefully.

Learn More : Four ways pharma companies can make their supply chains more resilient

Choosing the right distribution model is critical for successfully bringing your medical products to the Malaysian market. But a key question often arises: which type of partner truly masters the complex regulatory environment governed by the NPRA (National Pharmaceutical Regulatory Agency), MAL (Medical Device Authority) registrations, and MDA (Medical Device Authority) device classifications? For foreign companies, especially those unfamiliar with local specifics, this maze can present significant hurdles.

Local Malaysian distributors typically offer a distinct edge in regulatory navigation. They provide invaluable, hands-on assistance throughout the entire process. This includes meticulously preparing the necessary dossiers, proactively following up on application statuses, and crucially, interpreting nuanced feedback from authorities. Their deep integration within the local system translates to tangible benefits.

Direct Regulatory Access: They often have established relationships and direct lines to specialized regulatory consultants and MOH-approved agents, smoothing the path significantly.

Cultural & Regulatory Nuance: Intimate familiarity with mandatory language-specific labelling requirements and intricate halal certification processes prevents costly compliance missteps.

Market Adaptation: Local partners possess the agility to tailor product offerings effectively. They can readily adjust SKUs, for instance, introducing smaller pack sizes specifically to address the Malaysian market’s known price sensitivity, ensuring better market fit.

Conversely, international distributors bring their own strengths, primarily honed through broader global experience. They generally demonstrate strong capabilities in managing complex cross-border documentation, securing essential import permits, and ensuring overarching trade compliance across multiple regions. Their standardized systems offer robust control.

However, this international strength often hits a critical snag when unexpected local issues surface. Imagine a product suddenly flagged for a seemingly minor label non-compliance by the MOH. While the global team might possess the expertise, the necessity for approvals and decisions to filter through offshore layers frequently introduces frustrating delays. Real-world evidence shows this isn’t theoretical. Several brands relying solely on global partners experienced significant launch setbacks – typically ranging from 3 to 5 months – purely due to sluggish response times in addressing specific MOH queries or compliance demands. These delays directly impact market entry and revenue potential.

Therefore, the evidence strongly suggests local distributors consistently outperform when adaptability and swift local problem-solving are paramount. Their embedded presence allows rapid responses and adjustments crucial for navigating Malaysia’s specific regulatory intricacies. International models, meanwhile, tend to excel in environments demanding rigorous documentation control and leveraging standardized global compliance frameworks. Ultimately, the most effective choice hinges on whether immediate market agility or expansive documentation efficiency is your primary strategic driver for conquering Malaysia’s unique regulatory challenges. Success depends on aligning your partner’s core strengths with your most critical operational needs in this dynamic market. Sometimes the paperwork gets complex, requiring multiple checks.

Choosing the right pharmacy distribution partner is a pivotal decision impacting your brand’s bottom line. But which model – local or international – proves more cost-effective over the long haul? The truth is, it hinges entirely on your product specifics, launch complexity, and target pharmacy channels. There’s no universal winner, only the best fit for your unique scenario.

Beyond the basic product cost, pharmacy distribution involves multiple expense streams. Key considerations include:

Logistics & Fulfillment: Specialized handling like temperature-controlled cold-chain storage and transport adds significant cost, alongside last-mile delivery complexities to numerous pharmacy locations.

Promotional Investment: Gaining visibility requires budget for in-store sampling programs and securing prime shelf space through pharmacy display fees.

Hidden Operational Fees: Don’t overlook charges for documentation processing, managing product returns, or meeting mandatory minimum order quantities (MOQs). These can quickly erode margins if underestimated.

Independent, local pharmacy distributors often shine for smaller or niche brands. They typically offer greater flexibility in contract terms and are more accommodating of lower initial volumes. This can mean lower MOQ thresholds and willingness to execute phased, territory-specific marketing campaigns – crucial for cost-conscious market entry or testing. However, their smaller scale can sometimes translate into slightly higher per-unit costs. Think of a new skincare line entering Malaysia; a local partner allows for a controlled, budget-efficient rollout, adapting spend as the brand gains traction.

Major international players, such as DKSH, leverage vast networks to offer potentially better pricing, especially on large bulk shipments. This scale is advantageous. Yet, their models often come bundled with fixed promotional packages that might not align perfectly with your strategy, plus substantial onboarding fees. This structure generally favors established brands with multiple high-volume SKUs aiming for simultaneous nationwide saturation supported by major media campaigns.

So, when does each model make the most financial sense?

Opt for Local Partners: Ideal for niche products, low-volume launches, test markets, or brands needing phased geographic expansion. The flexibility and lower upfront commitments better suit cautious growth and managing cash flow in new territories.

Choose International Players: Best suited for broad, nationwide launches where you have high-volume products and plan significant media support. Their infrastructure efficiently handles massive scale, even if initial setup costs are steeper.

Ultimately, long-term cost-effectiveness isn’t about finding the cheapest option upfront. It’s about strategically aligning your distribution partner’s strengths – be it local adaptability or international scale – with your brand’s specific product profile, launch goals, and growth stage. Carefully weigh all cost components, including those hidden fees, against the tangible value each partner brings to your market entry or expansion plan. That’s how you unlock true efficiency.

Forget faceless transactions for a minute. When it comes to getting your health brand onto pharmacy shelves and, crucially, into the hands of Malaysian consumers, the power of genuine relationships remains absolutely pivotal. Seriously, it’s often the deciding factor. Why? Because Malaysia’s pharmacy sector thrives heavily on trust, built consistently through good old-fashioned, face-to-face interactions during sales conversations.

This is precisely where local Malaysian pharmacy distributors consistently demonstrate their unique value. Their teams aren’t just names on an email; their representatives physically visit pharmacies. Regularly. This boots-on-the-ground approach allows them to deliver essential product education directly, ensuring pharmacists and staff truly understand the offerings. They also handle Point-of-Sale Materials (POSM) with a keen eye for what resonates locally, avoiding generic, off-the-shelf solutions that might miss the mark culturally.

So, what specific relationship tools give local partners this edge?

Pharmacy Promoters: Having knowledgeable promoters right there in the pharmacy, engaging customers directly to explain product benefits – it’s personal, immediate, and builds confidence at the point of decision.

Staff Training: Conducting regular training sessions within the pharmacy itself empowers the staff. When they understand a product inside-out, they become genuine advocates.

Problem Solving Support: Local partners excel at providing hands-on support to swiftly address pharmacist concerns. Whether it’s questions about efficacy, navigating compliance specifics, or clarifying safety profiles, they’re there to resolve doubts quickly and personally.

Sure, massive global distributors might boast sophisticated e-learning platforms or centralized CRM systems. Technologically impressive, absolutely. But where they often stumble is replicating that authentic human touch and fostering deep, grassroots engagement with individual pharmacy outlets. This gap is very real.

A nutraceutical brand struggling for uptake in the Klang Valley partnered with a local distributor. The solution wasn’t just digital ads. The distributor orchestrated targeted on-site demo days and strategically placed health educators within pharmacies during peak weekend hours. This direct, high-touch engagement significantly boosted sales – a hyper-localized tactic global players rarely execute effectively, if at all, across numerous individual stores.

Ultimately, for brand managers navigating the Malaysian market, the distributor choice isn’t just about logistics or tech. It boils down to a fundamental question: Does your brand’s success hinge more on scalable automated systems, or does it demand the irreplaceable power of consistent, trusted human engagement within the pharmacy ecosystem? In Malaysia, the human element frequently wins out.

Learn More : Building Strong Relationships with Distributors in Malay-Speaking Countries | Pharmaceutical Retail Merchandising | Retailers and Health Systems Can Improve Care Together

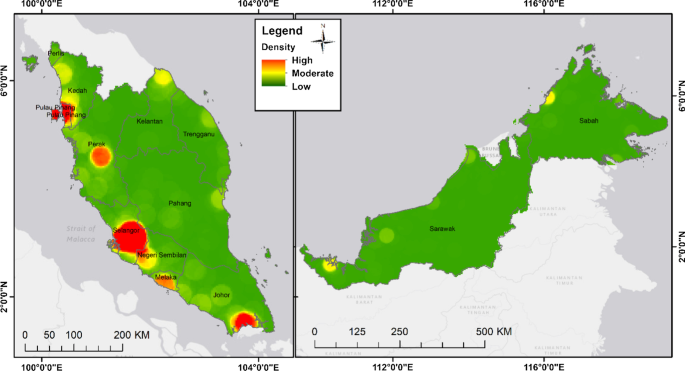

Getting essential medicines from manufacturer to pharmacy shelf across Malaysia presents a unique set of daily operational hurdles. The nation’s distinct geography is a primary driver of this complexity. Separated by the South China Sea, connecting East Malaysia (Sabah and Sarawak) with West Malaysia adds significant logistical layers. Compounding this, vast rural regions often suffer from underdeveloped infrastructure, creating a distribution landscape far from straightforward.

Brands operating here frequently grapple with several persistent issues:

Inventory Imbalances: Picture this: pharmacies in Sabah face empty shelves due to stock-outs, while warehouses in densely populated Selangor sit overflowing with the very same products. This mismatch is a constant battle, wasting resources and hindering patient access.

Shelf Delays: Even when stock is available, getting it onto pharmacy shelves isn’t guaranteed. Customs clearance can create unexpected holdups, and inconsistencies in labelling or documentation – seemingly minor details – can cause frustrating delays at critical points.

Cold Chain Fragility: Distributing temperature-sensitive medications (vaccines, biologics) reliably becomes exponentially harder outside major urban hubs. Maintaining the unbroken cold chain required for these products is a major operational headache in remote or rural locations.

When it comes to reliably serving pharmacies in hard-to-access areas, local Malaysian distributors often prove more effective. Their strength lies in deep-rooted relationships – not just with the smaller, niche pharmacies common outside cities, but crucially with the local drivers who know the terrain and routes intimately. This network allows them to maintain tighter inventory control and react swiftly when the unexpected happens, whether it’s sudden monsoon floods blocking roads or other unforeseen disruptions. They inherently handle exceptions and ad-hoc requests better, it’s baked into their operational model.

International distributors, conversely, often leverage centralized warehousing models designed for efficiency at scale. While powerful for high-volume corridors, this approach can struggle with the fragmented and exception-prone nature of the full Malaysian market. Their systems may have less tolerance for the frequent deviations from plan required to service every corner of the country effectively.

Therefore, within the dynamic context of Malaysian pharmacy retail, the ability to adapt quickly and handle complexity on the ground – operational flexibility – consistently proves more valuable than sheer scale alone. Success hinges on navigating the day-to-day realities of geography, infrastructure limitations, and the need for hyper-local responsiveness. Distributor partners who master this agility become indispensable allies in ensuring medicines reach every community.

Learn More : Common Mistakes to Avoid in Distribution in Malay‑Speaking Regions | Last‑mile strategy: Enabling speed and flexibility upstream

Deciding between local and international distribution partners is a critical crossroads for pharmacy brands entering or expanding within the Malaysian market. While there’s no single magic formula that fits every situation, navigating this choice effectively requires a clear strategic framework. Success hinges on carefully weighing several interconnected factors that directly impact your market penetration and operational efficiency. Let’s break down the key considerations:

1. What Exactly Are You Selling? (Product Category Matters)

The nature of your products significantly influences the ideal partner type. Prescription medications, demanding stringent temperature control throughout the supply chain, often benefit tremendously from the sophisticated, established cold-chain logistics typically offered by larger international distributors. Conversely, over-the-counter (OTC) items and supplements frequently rely heavily on in-pharmacy promotion and consumer education; here, partners with strong local networks and dedicated promoter teams on the ground usually deliver far better results.

2. Where’s Your Brand At? (Stage of Growth)

New market entrants generally find greater value with local Malaysian partners. These collaborators offer crucial market knowledge, flexibility to adapt quickly, and potentially lower initial setup costs – essential when testing the waters. Established brands with proven traction, however, might unlock significant advantages by leveraging the vast scale, extensive resources, and broader regional reach that major international distributors can provide.

3. Who Are Your Key Customers? (Target Channels)

Pinpointing your primary sales outlets is non-negotiable. If reaching independent community pharmacies is your main goal, local distributors with deeply ingrained relationships and hyper-local understanding become almost indispensable. But when targeting large chain stores or securing hospital tenders is the priority, partners possessing substantial scale, robust national coverage, and experience handling complex contracts – often international players – usually hold the edge.

4. Navigating the Rules (Regulatory Needs)

Malaysia’s regulatory landscape, including specific requirements like HALAL certification, MDA medical device registration, or product notification (NOT), presents a significant hurdle. If your products demand these local certifications or face complex compliance issues, choosing a partner with proven, hands-on experience navigating Malaysian authorities isn’t just helpful – it’s absolutely critical for avoiding costly delays or rejections. Local expertise shines here.

5. Resources & Timeline (Budget and Speed)

Are you sprinting for a rapid market launch, or meticulously building a long-term, sustainable presence? Your answer shapes the partnership. Faster entry might push you towards readily available local solutions, even if scaling later requires changes. Building for the long haul, however, justifies potentially higher initial investments with partners offering comprehensive, scalable infrastructure – often leaning international, but not always.

The most effective approach involves creating a simple decision matrix. List these five critical dimensions – Product Type, Growth Stage, Target Channels, Regulatory Hurdles, and Budget/Speed priorities. Then, systematically evaluate potential partners against each one, ranking them based on how well they align with your specific strategic needs. Remember, selecting the right pharmacy distribution service in Malaysia transcends mere logistics; it’s a fundamental strategic business decision with profound implications for your brand’s success and longevity in this dynamic market. Getting it right from the start really pays off, saving headaches and money down the line. It’s worth investing the time upfront to analyze properly.

Choosing between distribution models isn’t about declaring one universally “better.” Both local Malaysian pharmacy distributors and large international wholesalers hold distinct advantages. Your brand’s long-term success, however, hinges entirely on strategic alignment – matching the model precisely to your specific ambitions, product lifecycle, and target audience within this dynamic market.

So, which path unlocks your potential? If agility, rapid market feedback, and deeply localized support are your top priorities, partnering with a distributor pharmacy firmly rooted in Malaysia is often the smarter play. These partners excel at navigating the nuances of local regulations, building strong pharmacy relationships quickly, and adapting strategies based on real-time insights from the ground. They’re your boots on the street.

Meanwhile, if your primary goals involve massive scale, seamless standardization across systems, and ambitious expansion throughout the wider ASEAN region, then international pharmacy wholesale distributors typically bring the heavyweight infrastructure. They offer established networks, sophisticated logistics, and processes designed for cross-border efficiency, making them powerful engines for broad geographic reach.

Crucially, the objective isn’t simply finding the biggest name in distribution. It’s about identifying the right strategic partner – one whose capabilities perfectly mirror your product’s current stage of development, the complexities of its regulatory pathway, and the precise profile of your target customer in Malaysia. This alignment is the bedrock of sustainable growth.

🚪 Ready to Build Your Ideal Pharmacy Distribution Strategy in Malaysia?

Navigating the choice between local expertise and international scale can feel complex. That’s where PriooCare steps in. We specialize in seamlessly bridging the gap between your innovative product and the bustling pharmacy shelves across Malaysia. Whether you represent a pharmaceutical company, own a cutting-edge skincare brand, or are a health supplement innovator, our tailored distribution solutions provide the flexibility, comprehensive compliance support, and targeted market reach essential for thriving here.