September 6, 2025

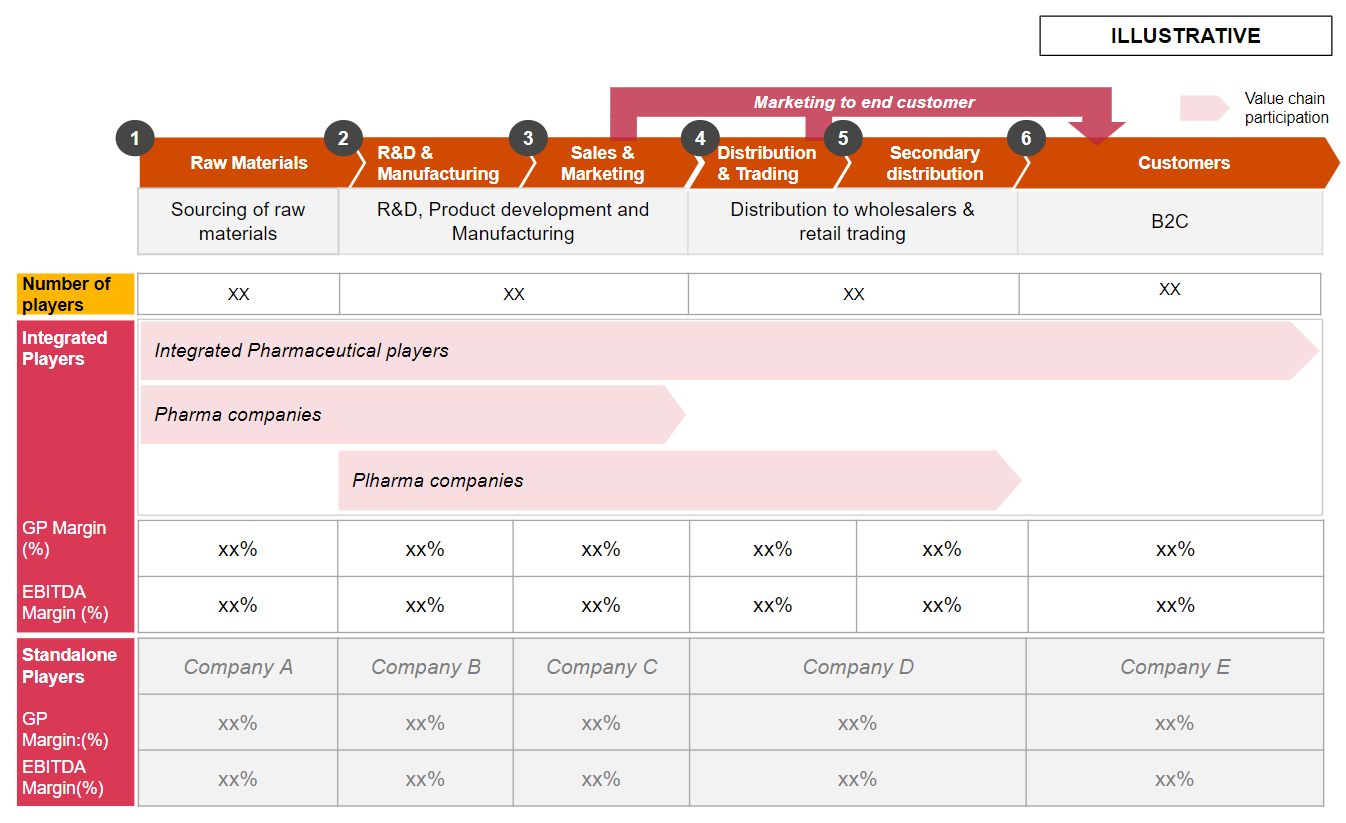

Have you ever walked into two different pharmacies in Malaysia—perhaps one in Kuala Lumpur’s bustling city center and another in a quieter suburban neighborhood—and noticed how one seems to consistently outperform the other, even if they stock similar products? The difference often isn’t just luck or location—it’s data-driven decision-making. For pharmacy distributors in Malaysia, whether they’re managing a single brand or overseeing multiple retail outlets, data isn’t just a collection of numbers—it’s the strategic backbone that fuels competitiveness and profitability.

Gone are the days when merchandising simply meant stocking shelves and hoping for the best. Today, trusted pharmacy distribution hinges on understanding what sells, why it sells, and how to optimize in-store execution efficiently. In Malaysia’s rapidly evolving pharmaceutical landscape, relying on actionable insights from merchandising partners isn’t just an advantage—it’s essential for survival.

So, what exactly does a merchandising services partner bring to the table for pharmacies in Malaysia? At its core, these expert teams ensure that products are visible, accessible, and presented in a way that maximizes consumer appeal. Their responsibilities span planogram compliance, stock replenishment, point-of-sale material (POSM) setup, and competitor monitoring, freeing up pharmacy owners and distributors to focus on big-picture growth strategies.

For pharmacy wholesale distributors and independent operators, these partners act as a reliable bridge between supply chain logistics and in-store execution. Consider this real-world scenario: A skincare brand distributing to major chains like Watsons or Guardian might rely on merchandising partners to ensure their serums and creams are placed at eye-level shelves—a proven strategy to boost sales. Meanwhile, an OTC distributor pharmacy could leverage these services to guarantee that promotional campaigns are rolled out seamlessly, complete with compliance evidence like time-stamped photos and outlet-specific reports.

The efficient execution of these tasks ensures consistent brand representation across all retail formats—from small mom-and-pop pharmacies in Ipoh to large chain stores in Penang. Without reliable merchandising support, even the most strategic distribution plans can fail due to poor in-store implementation.

Learn More : Top 10 Role of a Clinical Pharmacist

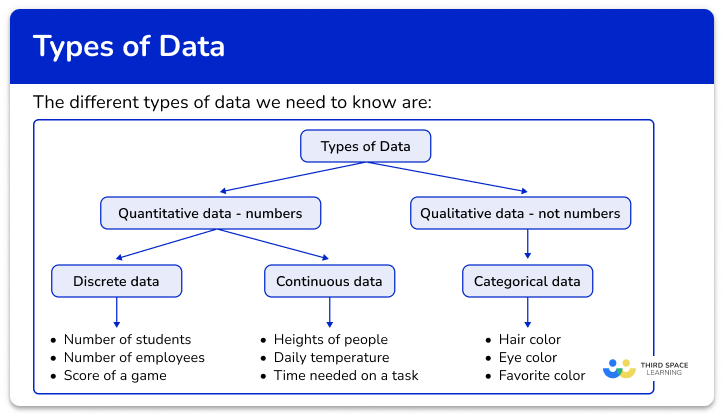

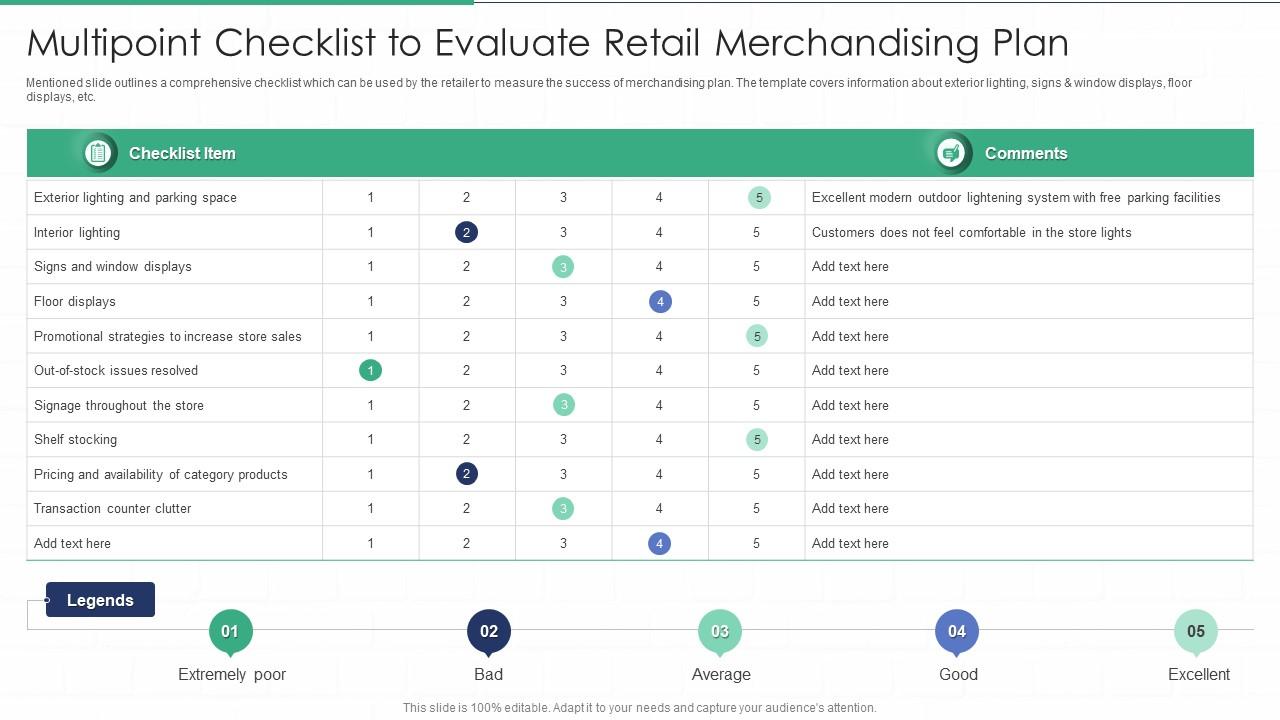

Are you receiving high-value data from your merchandising partner, or just generic reports that offer little actionable insight? Here’s a strategic breakdown of the essential data types you should be tracking:

Daily and weekly SKU-level sales trends

Regional variations in product demand (e.g., higher cold medicine sales in rainy states like Selangor)

Seasonal spikes or dips (e.g., increased vitamin sales during flu season)

Real-time stock levels to prevent out-of-stock or overstocking issues

Fast vs. slow-moving SKU analysis (e.g., a pharmacy distributor in Malaysia might notice that baby care products sell faster in family-centric neighborhoods)

Photo evidence of shelf placements

Shelf share measurements (how much space your brand occupies vs. competitors)

Placement accuracy (e.g., are products positioned according to agreed-upon layouts?)

Shopper engagement rates during campaigns

Sell-through velocity before, during, and after promotions

Competitor reactions (did rival brands increase discounts in response?)

Dwell time near product displays

Basket analysis (what products are commonly bought together?)

Competitor display audits (are rival brands using better signage or placement?)

For example, knowing that Vitamin C sales increased by 20% is useful—but understanding that this surge was driven by eye-level placements in urban pharmacies transforms raw data into a strategic advantage. Without these granular insights, brand managers and distributors miss critical opportunities to refine their merchandising investments.

Learn More : How analytics and digital will drive next-generation retail merchandising | Data and analytics are increasingly being incorporated into healthcare

Which reports should pharmacy distributors in Malaysia prioritize to make data-driven merchandising decisions?

Trusted sales analytics allow for rapid replenishment adjustments.

Example: If a distributor pharmacy notices declining multivitamin sales in East Malaysia, they can investigate whether it’s due to poor shelf placement, stock shortages, or competitor undercutting.

Tracks inventory turnover rates, preventing dead stock or missed sales.

Practical Implication: A skincare brand might discover that its luxury serums perform better in affluent neighborhoods like Bangsar, prompting tailored distribution strategies.

Combines photo verification with compliance scoring.

Why It Matters: Without this data, merchandising becomes guesswork—leading to inconsistent brand visibility.

Proof of POSM setup (dates, outlet codes, photographic evidence).

ROI Tracking: Pharmacy wholesale distributors can measure whether promotional spend translates to actual in-store execution.

When delivered in a reliable, structured format, these reports empower brands to make strategic decisions on product assortment, shelf positioning, and promotional investments.

Learn More : Pharmacy Merchandising: Best Practices for Product Pricing and Promotion in Malaysia

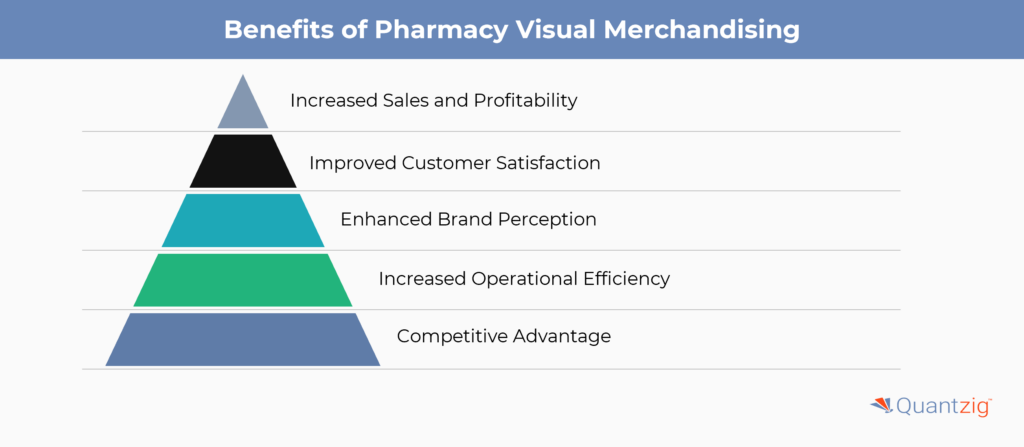

Which key performance indicators (KPIs) truly determine merchandising success in Malaysian pharmacies?

Measures the percentage of listed SKUs actually available on shelves.

Industry Benchmark: A 95%+ OSA is considered optimal for effective distribution.

Compares your brand’s shelf space to competitors’.

Example: If your pain relief products occupy only 20% of shelf space while the market leader holds 40%, it’s time for a planogram revision.

Tracks adherence to pre-approved shelf layouts.

Why It’s Essential: Ensures brand consistency across all outlets.

Measures incremental revenue after merchandising interventions.

Proven Use Case: A pharmacy distributor Malaysia team can use this to justify ROI to brand owners.

Tracks the percentage of outlets where campaigns were correctly implemented.

Reliable execution ensures nationwide campaigns achieve maximum consumer reach.

By consistently monitoring these KPIs, pharmacy distributors and brand managers can ensure their merchandising strategies remain data-driven, measurable, and effective.

Learn More : Role of Pharmacy Analytics in Creating a Data-Driven Culture

Ever wondered why some pharmacy brands in Malaysia consistently outperform competitors despite selling similar products? The difference lies in how they leverage merchandising data—not just collecting numbers, but turning them into strategic actions that drive real growth. For pharmacy wholesale distributors and retail partners, this isn’t about guesswork—it’s about proven, data-backed decisions that maximize shelf impact and sales velocity.

If your planogram compliance reports show only 70% adherence in Klang Valley pharmacies, don’t just note the gap—investigate the root cause. Is it due to:

Limited shelf space in high-traffic urban outlets?

Competitor pressure (e.g., rival brands paying for premium placements)?

Inconsistent merchandiser training leading to execution errors?

Real-World Example: A well-known supplement brand discovered their immune-boosting tablets were often placed on bottom shelves in Johor Bahru pharmacies despite being high-margin products. By retraining merchandisers and negotiating better shelf positions, they increased compliance to 92% within 3 months—resulting in a 28% sales lift.

Trusted industry data confirms that eye-level placements drive 30–40% higher sales compared to lower shelves. Yet, many brands still waste prime real estate on slow-moving items.

Strategic Fix:

✔ Prioritize high-demand SKUs (e.g., pain relievers, vitamins) at eye and hand-level zones.

✔ Reserve lower shelves for bulkier or less urgent products (e.g., family-sized shampoo bottles).

Malaysian Case Study: A local skincare distributor found their best-selling face serums were often stocked near the floor in Kuala Lumpur pharmacies. After repositioning them at eye level, sales surged by 34%—proving that shelf science trumps intuition.

Observational insights reveal nuances that sales reports miss. For instance:

Elderly shoppers prefer OTC medications placed at mid-shelf height for easier access.

Busy professionals gravitate toward grab-and-go displays near checkout counters.

Operational Tip: Use heat mapping tools or in-store cameras (where ethical) to track dwell time and product interaction patterns.

If a promotional campaign fails to boost sales, dig deeper than surface metrics. Ask:

Was the POSM (posters, shelf talkers) installed correctly? (Demand time-stamped photos as proof.)

Did competitors launch counter-discounts the same week?

Was the timing aligned with regional demand spikes (e.g., allergy season in Penang)?

Proven Fix: A pharma distributor in Malaysia analyzed a failed vitamin promo and realized 80% of outlets hadn’t set up displays by the launch date. After enforcing real-time compliance checks, their next campaign saw a 22% higher redemption rate.

Learn More : Rethinking retail operations for the omnichannel future

Why do 30% of merchandising data projects fail to deliver actionable value?

Problem: Merchandisers using different templates (Excel, WhatsApp photos, paper logs) create fragmented, unreliable data.

Strategic Solution:

Implement a unified digital platform with standardized fields (e.g., mandatory photo uploads, GPS tagging).

Example: A Selangor-based distributor reduced reporting errors by 65% after switching to a mobile audit app.

Problem: Weekly (or worse, monthly) reports stall decision-making. By the time you spot a stock-out trend, it’s too late.

Efficient Fix:

✔ Real-time dashboards showing live on-shelf availability (OSA).

✔ Automated alerts for urgent issues (e.g., a bestseller running low in Ipoh stores).

Problem: A merchandiser mistypes stock levels or forgets to log a store visit.

Reliable Prevention:

Monthly training refreshers on data protocols.

AI-powered validation (e.g., flagging “out-of-stock” claims without photos).

Malaysian Insight: A Kuching pharmacy chain cut data discrepancies by 40% after introducing mandatory photo audits for every merchandising visit.

Before finalizing plans with your merchandising services partner, verify:

✔ Daily/Weekly Sales Tracking – Can you see SKU-level performance by region?

✔ Planogram Compliance Depth – Are reports backed by photo evidence and scoring metrics?

✔ Stock Movement Visibility – Do you know which stores are overstocked or understocked in real time?

✔ Promotion Verification – Are campaign executions geotagged and timestamped?

✔ Shopper Insights – Do you understand how customers interact with displays?

✔ User-Friendly Delivery – Is data presented in clear, actionable formats (not raw spreadsheets)?

If 3+ boxes are unchecked, your brand is likely missing revenue opportunities.

Not all service providers offer strategic data support. Prioritize partners with:

✅ Proven Pharmacy Expertise – Look for case studies from Watsons, Guardian, or Alpro Pharmacy collaborations.

✅ Digital-First Tools – Mobile apps with GPS photo audits, not paper-based reports.

✅ Custom Analytics – Partners who interpret data trends (e.g., “Your brand loses 15% shelf share during monsoon months”).

✅ Transparent Compliance – Verified proof of every store visit (no “ghost merchandising”).

Local Example: A Kuala Lumpur health supplement brand switched to a data-focused merchandiser and saw planogram compliance jump from 68% to 89% in 6 months—directly increasing retail sales by 19%.

Learn More : How Independent Pharmacy Distributors Compete with Large Chains

In Malaysia’s crowded pharmacy sector, generic reports won’t cut it. Winning brands use tailored insights to:

Optimize shelf layouts for higher conversions.

Anticipate regional demand (e.g., stocking more flu meds ahead of haze season).

Outmaneuver competitors with smarter promo timing.

Q1: What are merchandising services?

Answer:

Merchandising services refer to professional support activities that ensure products are displayed, stocked, priced, and promoted correctly in retail stores. These services improve product visibility, maintain planogram compliance, and help retailers and brands boost sales performance.

Q2: What is an example of a merchandising service?

Answer:

An example is planogram execution, where a merchandiser arranges products on shelves according to a layout provided by the brand or retailer to ensure correct placement, facings, and category alignment.

Q3: What are the 4 types of merchandise?

Answer:

The four main types are convenience goods, shopping goods, specialty goods, and unsought goods, each classified based on consumer buying behavior and decision-making effort.

Q4: What are 5 examples of merchandising companies?

Answer:

Five examples include retail chains or service providers such as Walmart, Tesco, Aeon, Advantage Solutions, and Premium Retail Services, which offer both in-store merchandising and retail execution services.

Q5: What is a merchandising service team?

Answer:

A merchandising service team consists of trained personnel who visit stores to restock products, arrange shelves, update point-of-sale materials, check inventory levels, and ensure brand compliance.

Q6: What is a merchandise management system?

Answer:

A merchandise management system is a retail software platform that handles product planning, inventory control, pricing, purchasing, and sales tracking to optimize stock flow and reduce operational errors.

Q7: What is an example of a merchandising company?

Answer:

An example is Advantage Solutions, a global provider that offers in-store merchandising, retail support, product resets, and promotional execution for brands and retailers.

Q8: Is merchandising part of the supply chain?

Answer:

Yes. Merchandising is linked to the supply chain because it ensures the final step of product availability—making sure goods delivered by distributors are correctly displayed and accessible to customers.

Q9: What is merchandising in logistics?

Answer:

Merchandising in logistics refers to coordinating product flow from warehouses to retail shelves, ensuring timely replenishment, accurate stock levels, and correct placement to support sales and operational efficiency.

Q10: What is merchandising of goods and services?

Answer:

It involves presenting goods and services in a way that attracts customers, improves understanding, and increases purchase likelihood through proper placement, clear information, and consistent presentation across retail touchpoints.

Our marketing and sales teams use their strong relationships with the channel to create demand for your product at every stage of its lifecycle.

Demand creation services we offer: