September 1, 2025

What happens when a customer walks into a pharmacy and sees cluttered shelves, expired promotions, or incorrect price tags? They lose confidence. For any trusted pharmacy distributor Malaysia teams or independent pharmacy distributors, essential display compliance is more than visual neatness—it’s about maintaining brand integrity, regulatory standards, and shopper trust.

Non-compliance creates risks: regulatory penalties, brand image damage, and lost sales opportunities. For pharmacy wholesale distributors and distributor pharmacy field teams, ensuring displays are correct and compliant is a foundational aspect of reliable merchandising execution. Throughout this article, we’ll explore practical, strategic solutions to tackle these compliance gaps and strengthen retail performance.

Display compliance is often misunderstood in Malaysian pharmacy operations, leading to inefficiencies, regulatory risks, and lost sales opportunities. But what exactly does it entail? At its core, display compliance refers to strict adherence to predefined guidelines—covering product placement, promotional materials, pricing accuracy, and regulatory mandates—ensuring every shelf, endcap, and promotional display meets both brand and legal standards.

For example, a trusted pharmacy distributor Malaysia partner might provide a strategic planogram dictating that a high-demand vitamin supplement must occupy the middle shelf for optimal visibility. If misplaced, not only does it violate compliance, but it also weakens consumer trust and sales potential.

Malaysian pharmacies operate under a mix of brand mandates, distributor protocols, and NPRA (National Pharmaceutical Regulatory Agency) regulations. Here’s a breakdown of the most critical standards:

Brand Planogram Guidelines: These are tailored blueprints from manufacturers or pharmacy wholesale distributors, specifying exact shelf positions, product facings, and promotional placements. A deviation—like stacking skincare products in the wrong aisle—can disrupt purchase behavior.

Distributor Pharmacy Display Protocols: Standard operating procedures (SOPs) for merchandisers, covering shelf replenishment, promo material swaps, and compliance checks.

NPRA-Related Restrictions: Certain health supplements, over-the-counter (OTC) medicines, and cosmetics have strict rules on claims, positioning, and labeling. For instance, a product making unapproved health claims could trigger regulatory penalties.

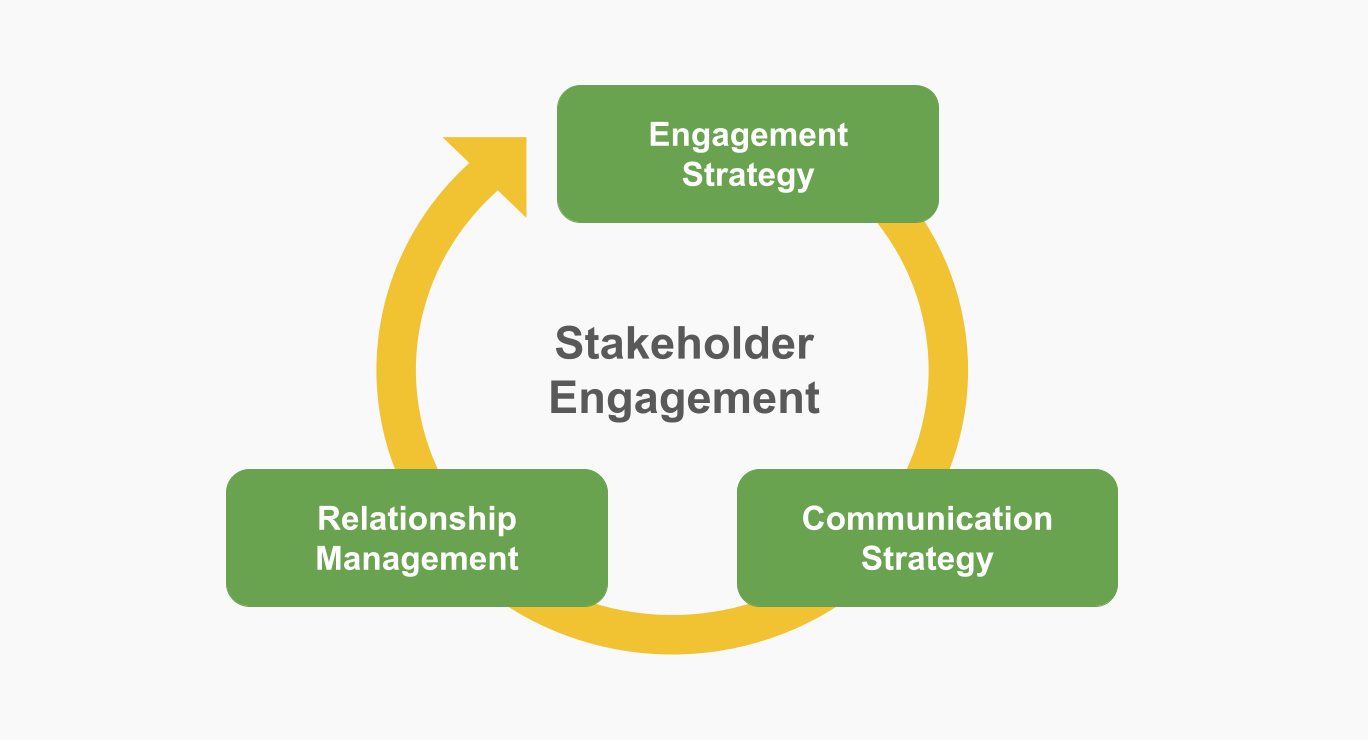

Multiple parties influence compliance success, and misalignment between them often leads to execution gaps:

Merchandisers & Field Teams – The frontline workforce responsible for implementing planograms, ensuring correct product facings, and removing expired promotional displays. Without efficient training, even the best guidelines fail in practice.

Pharmacists & Outlet Managers – They oversee daily compliance, ensuring pricing accuracy and that restricted products (e.g., codeine-based medicines) are displayed per NPRA rules.

Brand Owners & Distributors – They set strategic display objectives, aligning in-store execution with marketing campaigns. A reliable pharmacy distributor Malaysia partner ensures these standards are communicated clearly to retail teams.

A proven approach integrates all stakeholders—combining expert guidelines, field-level accountability, and effective communication—to maintain compliance without stifling operational flexibility.

Learn More : The Impact of Lighting, Layout, and Store Design on Pharmacy Merchandising in Malaysia | Joint FIP/WHO Guidelines on Good Pharmacy Practice

Walk into any Malaysian pharmacy, and you might spot recurring compliance pitfalls that hurt sales and brand credibility. Here’s a deep dive into the most frequent offenders:

Despite clear schematics, products often end up in the wrong sections. For example:

A new probiotic SKU meant for the digestive health aisle gets misplaced under general vitamins, reducing discoverability.

Incorrect facing counts (e.g., displaying three units instead of the mandated five) dilute brand visibility.

Real-World Example: A trusted pharmacy distributor Malaysia audit found that 40% of stores misplace at least 20% of SKUs, directly impacting sales performance.

Few things frustrate shoppers more than unmarked or incorrect pricing. A 2023 retail survey revealed that 68% of Malaysian consumers abandon purchases if prices are unclear. Common scenarios:

Promo prices not updated post-campaign.

Dual pricing (e.g., old and new tags left side by side).

Old campaign materials—buntings, wobblers, or shelf talkers—left beyond their validity period create compliance risks. For instance:

A pharmacy wholesale distributor runs a “Buy 1 Free 1” promo for a skincare brand but fails to remove materials post-campaign, misleading customers.

When shelves are crammed, products get buried. A strategic planogram loses its impact if:

Smaller SKUs are hidden behind larger packages.

Competitor products encroach on brand-designated spaces.

Operational Impact: A study by a leading distributor pharmacy firm showed that optimized shelf space can boost sales by up to 15%.

Learn More : Retail merchandising strategy and in-store marketing tactics

Why do pharmacies struggle with compliance despite having guidelines? The answer lies in systemic gaps:

Generic checklists fail to address store-specific challenges. For example:

A checklist might enforce brand-facing counts but ignore local shelf depth variations, leading to impractical setups.

Missing NPRA-specific validations (e.g., verifying health claim compliance on supplements).

Practical Implication: A reliable audit tool should blend brand standards, regulatory checks, and store-level adaptability.

Without continuous training, merchandisers default to old habits. Common issues:

No refreshers on updated planograms.

Unclear consequences for non-compliance.

Local Example: A Malaysian pharmacy distributor reduced errors by 30% after implementing quarterly training with role-playing scenarios.

When brand owners, distributors, and retailers operate in silos:

Promo timelines get misinterpreted.

Planogram updates aren’t relayed promptly.

Strategic Fix: Centralized digital dashboards for real-time guideline updates.

Learn More : Pharmacy Federal Rules and Regulations

A proven audit checklist is actionable, not bureaucratic. Here’s how to structure one:

✅ SKU-Level Planogram Verification

Correct shelf tier?

Right number of facings?

✅ Price & Promo Label Accuracy

Are all tags visible and updated?

✅ Promo Material Expiry Check

Remove outdated wobblers or banners.

✅ Out-of-Stock Reporting

Flag gaps to the distributor pharmacy immediately.

A trusted checklist for a Malaysian pharmacy might include:

NPRA-compliant claim checks for health supplements.

Verification of Malay/English bilingual labels.

Sample Checklist for Immediate Use

Are all products in the correct sequence per the planogram?

Are expired promo materials still displayed?

Do competitor products occupy brand-assigned slots?

By embedding essential validations into daily audits, pharmacies can turn compliance into a strategic advantage rather than a bureaucratic hurdle.

Learn More : Pharmacy Merchandising for New Product Launches in Malaysia

Ensuring consistent compliance across multiple pharmacy outlets isn’t just about setting rules—it’s about creating a culture where field teams take ownership of display standards. The challenge? Human error, shifting priorities, and inconsistent follow-ups often derail even the best-laid plans. So how can pharmacy wholesale distributors transform compliance from a box-ticking exercise into a strategic operational strength?

What gets measured gets managed. Without quantifiable benchmarks, compliance efforts become subjective. Reliable key performance indicators (KPIs) should include:

Planogram adherence rates (e.g., 90% compliance per outlet per audit cycle)

Pricing accuracy (e.g., zero unlabeled or mispriced items)

Promotional material expiry incidents (e.g., less than 5% outdated displays)

Real-World Example: A trusted pharmacy distributor Malaysia team reduced pricing errors by 62% within three months by tracking resolution times for discrepancies—proving that visibility drives accountability.

Paper checklists are outdated. Modern compliance thrives on:

Digital audit tools with photo verification (e.g., field teams upload real-time shelf images)

Automated alerts for recurring issues (e.g., flagging stores with chronic planogram deviations)

Structured feedback loops where supervisors provide effective coaching within 24 hours of audits

Operational Impact: A Johor Bahru-based distributor pharmacy cut audit processing time by 40% after switching to a mobile reporting system, allowing faster corrective actions.

People respond to incentives—and accountability. A strategic blend of motivation and corrective action includes:

✅ Monthly “Compliance Champion” awards (e.g., bonuses or public recognition for top-performing merchandisers)

✅ Retraining mandates for teams scoring below 70% in consecutive audits

✅ Escalation protocols for repeated non-compliance (e.g., store visit prioritization)

Local Insight: A Klang Valley pharmacy chain saw a 30% boost in compliance scores after introducing gamified leaderboards, proving that proven motivational tactics work.

Learn More : Understanding the ROI of Pharmacy Merchandising Investments in Malaysia

Merchandising excellence isn’t just the retailer’s responsibility—pharmacy wholesale distributors play a pivotal role in enabling compliance. Here’s how strategic support can bridge execution gaps:

Generic planograms fail when stores have unique layouts. Effective solutions include:

Store-specific planogram adaptations (e.g., adjusting shelf heights for outlets with limited space)

Customer flow analysis to position high-margin products in high-traffic zones

Modular display units for flexible promo placements

Case in Point: A Penang-based distributor pharmacy redesigned planograms for 50+ mini-outlets, increasing compliance rates from 54% to 88% by accommodating smaller footprints.

Classroom training forgets. Micro-learning sticks. Efficient approaches involve:

5-minute video refreshers before major campaign rollouts

QR code-linked training on planogram updates (scanned during store visits)

Role-playing audits to simulate real-world compliance scenarios

Data Point: Teams trained via mobile micro-modules retain 28% more procedural knowledge than those in traditional sessions (Malaysian Retail Institute, 2023).

Miscommunication causes 43% of compliance errors (PharmaExec Malaysia). Reliable fixes include:

Dedicated Telegram groups for instant campaign updates

Centralized digital hubs hosting the latest NPRA guidelines

Weekly voice notes from area managers clarifying common audit pitfalls

Learn More : How analytics and digital will drive next‑generation retail merchandising

A global vitamin brand struggled with 58% planogram compliance across KL outlets. Their trusted pharmacy distributor Malaysia partner implemented:

Customized audit checklists with SKU-level validations

Biweekly “mystery shopper” audits to verify field reports

Digital dashboards tracking real-time compliance

Result: 92% compliance within two months, plus a 15% sales lift for repositioned SKUs.

Expired buntings plagued 30% of a skincare brand’s displays. The distributor pharmacy team deployed:

AI-powered image recognition to flag outdated promo materials

Incentives for perfect audit scores (e.g., gift cards)

Outcome: 80% fewer expired displays in one campaign cycle.

Baseline Assessment

Conduct surprise audits at 20% of outlets to identify critical gaps.

Checklist Customization

Blend NPRA rules, brand guidelines, and store realities.

Field Team Upskilling

Replace manuals with interactive e-learning.

KPI Tracking

Monitor via cloud-based tools with auto-generated reports.

Recognition Programs

Reward top performers with non-cash incentives (e.g., flexible shifts).

Checklist for Managers

✅ Are audit tools user-friendly for field teams?

✅ Do training modules include local regulatory updates?

✅ Is compliance data visible to all stakeholders?

Builds Shopper Trust: 73% of Malaysians abandon purchases if pricing seems inconsistent (Nielsen 2024).

Prevents Regulatory Risks: NPRA fines for non-compliance can exceed RM 50,000 per violation.

Boosts Brand Equity: Consistent displays increase recognition by up to 40% (Malaysia Brand Analytics).

In Malaysia’s competitive pharmacy landscape, reliable display compliance isn’t optional—it’s the backbone of consumer trust and operational excellence. From tailored audits to strategic field team empowerment, every step must align with brand and regulatory goals.

Q1: What is the planogram compliance?

Answer:

Planogram compliance is the level of accuracy between the approved planogram and how products are actually arranged on the shelf. It ensures correct product placement, facings, stock levels, and category flow according to the brand or pharmacy’s visual merchandising standards.

Q2: What is a planogram in pharmacy?

Answer:

A planogram in pharmacy is a visual layout or diagram that shows exactly where each product should be placed on the shelves. It guides staff to organize OTC medicines, supplements, skincare, and medical items in a way that improves visibility, navigability, and sales.

Q3: What is compliance pharmacy?

Answer:

Compliance in pharmacy refers to following all required operational, regulatory, merchandising, and safety standards. This includes KKM/NPRA guidelines, SOPs, planograms, pricing accuracy, expiry management, and proper display of healthcare products.

Q4: What are the key factors to consider when designing a planogram for a pharmacy?

Answer:

Key factors include category hierarchy, shopper flow, product demand, eye-level visibility, safety regulations, stock turnover, space allocation, and ensuring essential health items are easy to locate.

Q5: What is the rule of planogram?

Answer:

The main rule of planograms is “the right product in the right place, with the right facings, at the right time.” It ensures consistent shelf presentation, optimized sales, and an organized customer experience.

Q6: What are the 5 keys of compliance?

Answer:

The five keys of compliance are accuracy, consistency, documentation, accountability, and continuous monitoring. Together, they ensure standards are followed correctly across all outlets.

Q7: What are the four key planogram objectives?

Answer:

The four key planogram objectives are improving product visibility, enhancing shopper navigation, maximizing sales potential, and ensuring efficient shelf space management.

Q8: What is the planogram standard?

Answer:

A planogram standard is a set of rules that dictates product placement, number of facings, shelf sequence, SKU priority, and category flow. It ensures uniformity across all pharmacy branches.

Q9: What is the purpose of a planogram?

Answer:

The purpose of a planogram is to organize shelves systematically so customers can find products quickly, improve sales conversion, support inventory accuracy, and maintain consistent retail execution.

Q10: What is compliance in retail?

Answer:

Compliance in retail means following all required policies, laws, standards, and operational procedures—including pricing accuracy, display rules, health and safety guidelines, and correct execution of merchandising tasks.

Our marketing and sales teams use their strong relationships with the channel to create demand for your product at every stage of its lifecycle.

Demand creation services we offer: