January 28, 2026

The landscape of healthcare retail in Malaysia is undergoing a profound transformation. Gone are the days when pharmacies functioned as simple dispensaries; today, they are dynamic shopper-centric environments where competition for customer attention is intense. This shift makes visual merchandising (VM) not just a decorative afterthought, but a strategic, reliable, and essential component for success in pharmacy distribution. For brands aiming to secure shelf space, for pharmacists striving to enhance patient care and business viability, and for pharmacy distribution service in Malaysia providers tasked with flawless execution, mastering VM is non-negotiable. At its core, effective visual merchandising in this regulated space serves three interconnected goals: capturing shopper attention, improving purchasing convenience, and ultimately driving sales performance. This approach moves beyond mere product placement to create a compelling, informative, and navigable retail experience that aligns with both commercial objectives and the trusted healthcare mission of Malaysian pharmacies.

So, what exactly does visual merchandising entail within the unique framework of a Malaysian pharmacy? It is the strategic science and art of presenting products—from Over-The-Counter (OTC) medicines and vitamin supplements to medical devices and personal care items—in a way that maximizes their appeal and accessibility while strictly adhering to regulatory guidelines. This discipline is intrinsically linked to brand compliance and planogram execution. A planogram is the blueprint for success, a detailed schematic that dictates exactly where and how each product should be placed on the shelf. For independent pharmacy distributor networks and large pharmacy wholesale distributors, VM is the critical, on-ground action that brings these blueprints to life. It’s how they ensure that a brand’s investment in shelf space translates into tangible visibility, making their service a trusted and efficient link between manufacturers and retail points. Crucially, pharmacy VM differs from general retail. It must balance persuasive appeal with a sense of professional authority and trust. Displays must be engaging but never misleading, especially for regulated categories where health claims are scrutinized by the Ministry of Health (KKM). The role of the distributor pharmacy team, therefore, requires an expert blend of retail acuity and regulatory awareness.

Checklist: Key Elements of Pharmacy-Specific Visual Merchandising:

KKM Regulation Compliance: Ensuring all displays and claims adhere to health ministry guidelines.

Category Clustering: Logical grouping of products (e.g., cough & cold, digestive health, pediatric care).

Planogram Adherence: Faithful execution of the brand-approved shelf layout.

Informational Signage: Clear, accurate health information and pricing.

Brand Blocking: Maintaining cohesive brand sections for stronger visual impact.

Learn more : WHO – Good Pharmacy Practice (GPP) Guidelines

In the bustling aisles of a Guardian, Caring, or even a neighborhood Alpro Pharmacy, the first few seconds of a shopper’s gaze determine everything. Visual impact is the primary hook. For Malaysian shoppers, who are increasingly health-conscious but often time-pressed, a cluttered or confusing shelf leads to decision fatigue. Strategic VM cuts through the noise. This involves meticulous placement strategies that leverage known hot spots like eye-level shelves and promotional end-caps—the prime real estate of any retail space. Colour psychology and targeted lighting can create powerful focal points, drawing the eye to new product launches or high-margin items. However, this creativity is always bounded by professional integrity and KKM regulations, ensuring promotions are responsible, especially for sensitive health products.

The task of maintaining this proven, consistent visibility falls heavily on the shoulders of distributor pharmacy field teams and merchandisers. These are the expert executors on the front lines. From a pharmacist’s perspective, effective attention-drawing VM is a tremendous aid. It reduces customer confusion and improves product differentiation, allowing pharmacy staff to focus more on consultative roles rather than constantly guiding shoppers to find basic items. A well-merchandised shelf does the initial introduction, making the pharmacist’s subsequent advice more effective.

Learn more : NielsenIQ – Shopper Behaviour & Retail Psychology

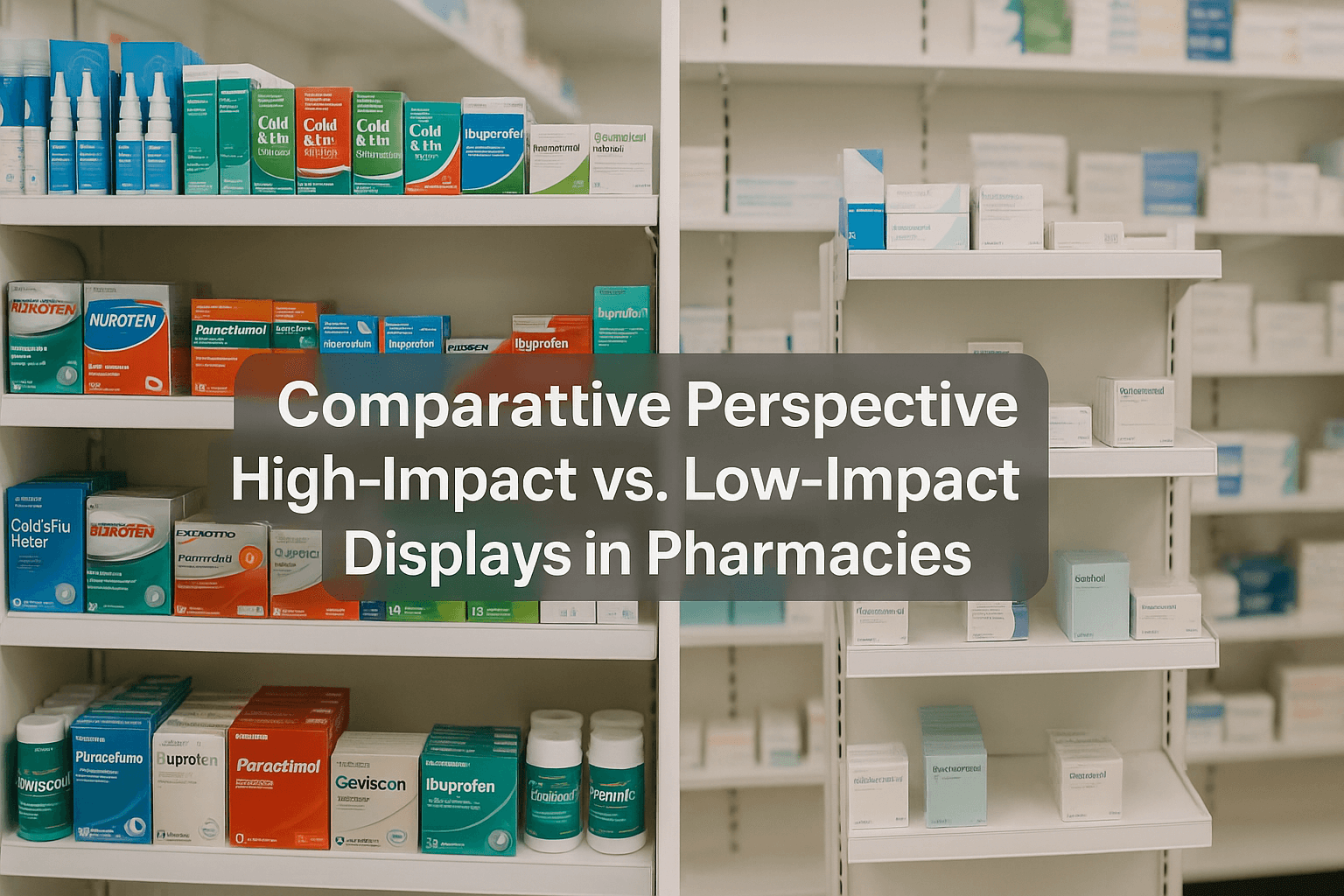

| Feature | High-Impact Display (Strategic VM) | Low-Impact Display (Passive Stocking) |

|---|---|---|

| Product Placement | Uses eye-level zones & promotional bays for key items. | Products placed haphazardly, often based on delivery order. |

| Category Signage | Clear, bold signage for health categories (e.g., “Diabetes Care”). | Minimal or generic signage, forcing shoppers to search. |

| Brand Blocking | Creates strong visual blocks by brand or sub-category for clarity. | Products scattered, diluting brand presence and confusing shoppers. |

| Promotional Integration | KKM-compliant promo tags are highlight and aligned with stock. | Promotional materials are outdated, missing, or non-compliant. |

| Shopper Experience | Intuitive and engaging; guides the shopper’s journey naturally. | Frustrating and inefficient; leads to abandoned purchases. |

Once attention is captured, convenience takes over to complete the journey. For the Malaysian shopper—a parent seeking pediatric fever relief, a senior citizen managing chronic supplements, or a professional grabbing a quick health boost—efficient navigation is paramount. Strategic shelf zoning and logical category grouping are the unsung heroes of VM. Imagine a pharmacy where all prenatal vitamins, calcium supplements, and joint care products are clearly grouped and signposted. This intuitive product flow transforms a stressful search into a smooth, self-guided experience. This level of organization is a core deliverable of a professional pharmacy distribution service in Malaysia.

Such services ensure reliable and tailored execution of standardized planograms across diverse retail chains, from nationwide giants like Guardian and Caring to key regional players like Multicare. Consistency here is key. A shopper should find a similar, logical layout whether they walk into a pharmacy in Kuala Lumpur or Penang, building trust in the retail brand. This execution often involves a partnership between a brand or distributor’s field merchandisers and a pharmacy’s in-house staff. A clear division of labor, guided by a strategic framework, ensures gaps are covered and standards are maintained.

From the pharmacist’s point of view, this convenience directly translates into operational efficiency. They spend significantly less time redirecting customers or answering basic locational questions, freeing them up for meaningful patient consultations—a core aspect of their professional service. From the distributor’s perspective, it’s about reliable, standardized execution. Their merchandisers become an extension of the pharmacy’s retail ops, ensuring every outlet receives the same tailored attention to detail, which is essential for maintaining service contracts and brand partnerships.

Framework: Role Comparison in Planogram Execution

Distributor/Field Merchandiser:

Primary Role: Expert execution of national/regional planograms.

Focus: Ensuring brand compliance, stock rotation (FIFO), and promotional setup.

Strength: Cross-outlet consistency, and bringing proven brand strategy to life.

Challenge: Limited daily presence in any single store.

Pharmacy In-House Staff:

Primary Role: Daily maintenance and replenishment.

Focus: Restocking sold items, basic front-facing, and immediate tidiness.

Strength: Constant presence, able to fix minor disarray quickly.

Challenge: May lack dedicated training on strategic VM principles.

The ultimate measure of effective visual merchandising is its impact on the bottom line. Strategic presentation directly influences purchase decisions, encouraging product trial and fostering repeat purchases. A clear, appealing display of a new immune support supplement or a blood pressure monitor can be the final nudge a hesitant shopper needs. Furthermore, KKM-compliant promotional messaging—think “Doctor Recommended” or “Sugar-Free”—adds a layer of trusted persuasion that aligns with health-seeking behaviors. The sales benefits are also operational: improved visibility and logical grouping lead to better inventory turnover. Fast-moving items are easily identified and restocked, while slow-movers can be strategically repositioned or flagged for review.

This is where the role of pharmacy wholesale distributors evolves from logistics providers to strategic partners. By collecting and analyzing VM execution data—what layouts drive sales, which promotions resonate—they contribute to more accurate demand forecasting. This data-driven feedback loop allows for smarter inventory management and tailored merchandising recommendations for different pharmacy segments.

The perspective of a Brand Manager is sharply focused on sell-out targets. For them, a perfectly executed planogram is the culmination of their marketing strategy. They rely on the distributor pharmacy network as their final-mile salesforce, ensuring their products are not just present, but presented for maximum conversion. They need efficient and expert alignment between their brand vision and the retail reality. Conversely, from the Distributor’s POV, driving sales through effective VM solidifies their value proposition. It demonstrates that their service goes beyond warehousing and delivery; it encompasses retail performance optimization. By proving they can move stock off the shelf faster, they become an indispensable, strategic partner to both brands and pharmacies, creating a proven model for mutual growth in Malaysia’s competitive healthcare retail market.

The journey from a brand’s warehouse to a product’s final placement on a pharmacy shelf is a complex ecosystem where visual merchandising (VM) success is directly shaped by the capabilities and structure of the pharmacy distribution service in Malaysia. The Malaysian retail pharmacy landscape is broadly split between large chain pharmacies (like Guardian, Watsons, Caring) and a vast network of independent outlets and small chains (like Alpro, Multicare). This dichotomy creates a fundamental challenge for brands: achieving nationwide VM consistency across vastly different retail environments. This is where the role of an independent pharmacy distributor becomes strategic and irreplaceable. For brands without direct retail agreements or the operational bandwidth to manage thousands of individual stores, these distributors are the trusted field force that translates national planograms into local reality. Their responsibilities are multifaceted, extending far beyond simple delivery to encompass rigorous planogram compliance, the strategic placement of Point-of-Sale Materials (POSM), and disciplined stock rotation following the First-In, First-Out (FIFO) principle. They are the essential link ensuring that a promotional display for a new cough syrup in a Kuala Lumpur Guardian has the same impact and compliance as its counterpart in a smaller pharmacy in Kuching.

However, this execution is fraught with localized challenges. Independent outlets often grapple with severely limited shelf space, forcing distributors to make expert judgment calls on product prioritization. Rural pharmacies might face logistical hurdles that affect the freshness of slow-moving Stock Keeping Units (SKUs), risking expiry and display degradation. Furthermore, managing brand conflicts—where multiple products with similar color schemes or health claims compete for attention—requires a nuanced, on-the-ground approach. A strategic distributor partnership is what elevates VM from a hoped-for outcome to a measurable, managed process. The right partner doesn’t just deliver boxes; they provide actionable intelligence from the field, help navigate retailer-specific requirements, and employ proven merchandising routines to overcome these pervasive obstacles, ensuring the brand’s visual identity and commercial objectives remain intact at every single touchpoint.

Learn more : Why Your Pharmacy Needs a Merchandising Service Partner | PwC Health Research Institute – Supply Chain Report

Even with a reliable distribution partner, the day-to-day reality of a Malaysian pharmacy shelf presents a series of consistent VM hurdles. The most visible is the issue of extremely high SKU density. With thousands of products—from essential OTC medications and specialized supplements to personal care items and durable medical devices—competing for finite linear shelf space, clutter is a constant threat. This clutter directly undermines all three core VM goals, obscuring products, confusing shoppers, and stalling sales. Stockouts present another critical problem; a gap on the shelf where a key product should be not only represents a lost sale but also breaks the integrity of the planned display, making adjacent products look neglected and reducing overall category appeal. From the brand manager’s perspective, these challenges manifest as planogram non-compliance and wasted promotional investments. For the pharmacist or store owner, they result in operational inefficiency, frustrated customers, and potential revenue leakage.

Overcoming these issues requires a proven and systematic approach, heavily reliant on the expertise of the distributor pharmacy team. Their effective merchandising routines are the frontline defense. For instance, in the vitamin and supplements aisle—a high-value, high-competition category—a distributor merchandiser will aggressively manage category zoning to prevent crossover, ensuring prenatal vitamins are not intermixed with sports nutrition, which confuses the shopper journey. In wound care sections, they prioritize clear benefit-oriented signage (e.g., “Advanced Healing,” “Water-Resistant”) to aid selection, while for medical devices like blood glucose monitors, they ensure demo units and informational leaflets are always present and accessible. The solution lies not in a one-time fix but in consistent, audit-driven maintenance. Distributors utilize merchandising checklists and mobile reporting apps to document shelf conditions, report stockouts in real-time, and ensure that every store visit reinforces the strategic display standards, turning chaotic shelves into curated, high-performing commercial spaces.

Comparative Framework: In-House vs. Distributor-Led VM Challenge Management

| VM Challenge | Typical In-House/Store Staff Approach | Strategic Distributor Pharmacy Team Approach |

|---|---|---|

| High SKU Density & Clutter | Reactive tidying; may lack category management principles. | Proactive space optimization using planograms; expert pruning of slow-movers and logical grouping. |

| Planogram Compliance | Often secondary to daily stocking tasks; can vary by individual. | Core KPI; executed with military precision using digital planogram tools; photos as proof of execution. |

| Managing Stockouts & Gaps | May simply leave gap or fill with wrong product, breaking the display. | Immediate reporting to supply chain; employs forward-facing techniques to minimize visual impact of gaps. |

| POSM & Promotional Setup | Can be delayed or installed incorrectly, missing promo windows. | Integral part of the service visit; ensures timely, compliant setup and removal of promotional materials. |

| Cross-Brand Conflict Management | May not have authority or insight to make strategic display decisions. | Acts as neutral arbiter based on brand agreements and retail performance data to optimize shelf for all. |

Translating theory into tangible, sales-driving action requires a set of practical, actionable strategies that any pharmacy or brand can implement, especially when supported by a competent pharmacy distribution service. The first essential step is detailed store layout mapping. Understanding the natural customer flow path—from the entrance, past the prescription counter, to the OTC aisles and checkout—allows for the strategic placement of high-impulse categories like vitamins or pain relief in high-traffic hot spots. Within the aisles, employing the Rule of Three for product grouping creates a psychologically pleasing and effective display; for example, grouping a premium, mainstream, and value-tier vitamin C supplement together allows for clear comparison and can effectively trade the customer up. For the field teams, a simple but non-negotiable compliance checklist is a powerful tool to ensure every detail is covered, from checking expiry dates and FIFO rotation to verifying that all KKM-compliant health claims are correctly displayed and that planogram adherence is above 95%.

This is where the technological and operational muscle of pharmacy wholesale distributors and independent pharmacy distributor networks transforms strategy into scalable execution. Modern distributors leverage mobile reporting applications that allow merchandisers to submit geo-tagged, time-stamped photos of displays directly from the store floor. This provides real-time audit trails and performance analytics. For a brand manager monitoring a launch in Guardian stores across the Klang Valley, this means receiving instant visual confirmation of display integrity. For an Alpro pharmacy franchise owner, it provides assurance that standardized merchandising protocols are being followed across all their outlets. This data-driven feedback loop enables continuous optimization. If a particular product grouping in Caring pharmacies is underperforming, the planogram can be adjusted and the change communicated and enforced through the distributor network with remarkable speed, making the entire VM process agile, responsive, and deeply effective.

The path to stronger pharmacy retail performance in Malaysia’s competitive market is inextricably linked to mastering the three interconnected pillars of visual merchandising: creating unmissable attention, delivering frictionless convenience, and driving measurable sales growth. This discipline is far more than shelf decoration; it is an essential, reliable, and data-driven tool within the broader pharmacy distribution ecosystem. When expert brand strategy, tailored distributor execution, and informed retail partnership align, the result is a transformative in-store experience. It is an experience that serves the Malaysian shopper’s need for clarity and trust, supports the pharmacist’s role as a healthcare advisor, and delivers the proven commercial outcomes that brands and retailers require. Embracing this integrated, strategic view of VM is not merely an option but a fundamental requirement for anyone committed to leadership in Malaysia’s evolving healthcare retail landscape.

For brands seeking to navigate this complex landscape and ensure their visual merchandising investment translates into consistent shelf presence and performance across Malaysia, partnering with a specialized expert is the critical next step.

Q1: What are the goals of visual merchandising?

Answer:

The main goals of visual merchandising are to attract customers, guide them through the store effectively, and increase sales. It enhances product visibility, improves the shopping experience, and strengthens brand identity.

Q2: Which is the most important goal of visual merchandising?

Answer:

The most important goal is to influence purchasing decisions by making products appealing and easy to understand. A well-designed display helps customers notice, compare, and choose items quickly.

Q3: What is the goal of merchandising?

Answer:

The goal of merchandising is to present the right product, in the right place, at the right time, and at the right price. It ensures shoppers find what they need while retailers achieve strong sales performance.

Q4: What are the 4 P’s of visual merchandising?

Answer:

The 4 P’s are Presentation, Pricing, Promotion, and Placement. These guide how products are displayed, communicated, and positioned to maximise visibility and sales.

Q5: What are the 4 pillars of merchandising?

Answer:

The 4 pillars are Product, Pricing, Placement, and Promotion. They form the foundation for planning assortments, setting prices, organising displays, and driving customer engagement.

Q6: What are the 5 R’s of merchandising?

Answer:

The 5 R’s are Right Product, Right Place, Right Time, Right Price, and Right Quantity. These ensure stock availability, shopper satisfaction, and smooth retail operations.

Q7: What are the 7 principles of merchandising?

Answer:

The 7 principles include Balance, Harmony, Emphasis, Contrast, Rhythm, Proportion, and Unity. These design principles help create visually appealing and effective product displays.

Q8: What are the five main functions of a visual merchandiser?

Answer:

Key functions are planning store layouts, creating displays, maintaining brand consistency, analysing shopper behaviour, and coordinating promotions to support sales goals.

Q9: What is the 80/20 rule in merchandising?

Answer:

The 80/20 rule suggests that 80% of sales often come from 20% of products. Merchandisers use this to prioritise bestsellers and allocate prime shelf space efficiently.

Q10: What are the 7 functions of merchandising?

Answer:

The 7 functions include buying, assortment planning, pricing, display management, inventory control, promotion coordination, and sales analysis.

Our marketing and sales teams use their strong relationships with the channel to create demand for your product at every stage of its lifecycle.

Demand creation services we offer: